Gold A Strategic Investment

Gold’s Quiet Strength: Why Strategic Investors Are Paying Attention

Gold is once again commanding serious attention — not as a speculative trade, but as a strategic asset.

In today’s environment of persistent inflation pressures, elevated global debt, geopolitical tension, and shifting central bank policy, investors are reassessing portfolio resilience. While equities continue to offer growth potential, volatility has reminded many that diversification is not optional — it is essential.

Gold has historically played a distinct role in that equation.

Unlike paper assets, gold is a tangible store of value with a 5,000-year track record of preserving purchasing power. It is not tied to the performance of a single company, currency, or government. That independence is precisely what makes it compelling during uncertain economic cycles.

Recent trends show increased accumulation by central banks and sustained interest from long-term investors. This activity suggests positioning for stability rather than short-term momentum. Gold’s strength in this cycle reflects structural concerns about currency debasement, real interest rates, and long-term fiscal discipline.

Importantly, gold is not a replacement for equities or productive assets. It is a complement — a stabilizer that can help reduce overall portfolio volatility when markets experience stress.

Disciplined investors understand that preparation often outperforms reaction. Allocating a measured percentage of a portfolio to gold can provide both diversification and psychological resilience during turbulent periods.

Markets evolve. Monetary systems shift. Economic cycles repeat.

Gold endures.

For investors seeking balance in an increasingly complex financial landscape, gold remains not merely relevant — but strategic.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Metal In Jewelry

New Metal Coatings in Jewelry: Hematite Plating, Gold Plating, and Rhodium Plating

Jewelry has evolved beyond traditional gold and silver, with new plating techniques enhancing both aesthetics and durability. Today, hematite, gold, and rhodium plating offer stylish and affordable options for consumers.

Hematite Plating

Hematite plating gives jewelry a sleek, dark metallic finish, resembling gunmetal or blackened steel. While natural hematite is a mineral known for its metallic sheen, the plating process involves coating base metals like brass or stainless steel with a hematite-colored layer. This type of plating is popular in modern, edgy jewelry designs and is often used for men’s accessories and statement pieces.

Gold Plating

Gold plating remains a popular choice for jewelry lovers who want the look of gold without the high price. This process involves electroplating a thin layer of gold over a base metal like brass, silver, or stainless steel. The thickness of the gold layer, measured in microns, affects durability—thicker plating lasts longer. While gold-plated jewelry may tarnish over time, proper care can extend its lifespan.

Rhodium Plating

Rhodium plating is widely used to enhance the durability and shine of white gold and sterling silver jewelry. Rhodium, a rare and highly reflective metal, creates a bright, mirror-like finish that resists tarnish and scratches. It also provides a hypoallergenic barrier, making it ideal for sensitive skin. Over time, rhodium plating may wear off and require reapplication to maintain its luster.

These innovative plating techniques allow jewelry enthusiasts to enjoy a variety of styles while balancing cost and durability. Modern jewelry offers something for every taste, whether seeking a bold hematite finish, a classic gold-plated piece, or a brilliant rhodium-coated ring.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold at social Markets

An Insight into Buying Gold at Flea Markets and Farmer’s Markets

Buying gold at flea markets and farmer’s markets can be an excellent way to acquire physical gold at potentially lower prices than traditional dealers or online retailers. However, it also comes with risks and challenges that require careful consideration. Here’s an insight into what to expect when buying gold in these unconventional settings and how to make the most of your purchases.

1. Potential for Bargains

One of the main attractions of buying gold at flea markets and farmer’s markets is the possibility of finding great deals. Sellers in these markets often offer gold items like jewelry, coins, or small bars at prices below retail value. Some sellers may not be fully aware of the true value of the gold pieces they possess, allowing savvy buyers to purchase gold at a discount. This can be an excellent opportunity to expand your gold holdings affordably.

2. Unique and Rare Finds

Flea markets and farmer’s markets can be treasure troves of unique and rare gold items. Unlike traditional gold shops that focus on standard coins and bars, these markets often feature antique jewelry, heirloom pieces, vintage coins, and other unique forms of gold that may not be available elsewhere. If you are interested in collecting gold items with historical or artistic value, these markets can provide access to a wide variety of distinctive pieces.

3. Negotiating Power

Buying gold at flea markets and farmer’s markets often comes with more room for negotiation than in formal retail settings. Sellers are typically more flexible with their pricing and may be willing to offer discounts if you pay in cash or buy multiple items. This gives you the chance to negotiate a fair price and potentially secure a better deal than you would get elsewhere.

4. Risks of Counterfeit Gold

While there are benefits to buying gold in these settings, there are also risks, particularly the risk of purchasing counterfeit or misrepresented gold. Unlike certified dealers, flea market and farmer’s market sellers may not have a reputation to uphold or be subject to strict regulations. It’s essential to be cautious and conduct thorough due diligence to avoid buying fake or gold-plated items. Always carry a portable gold testing kit, a magnet (since gold is non-magnetic), or a small scale to check the weight and authenticity of the gold items.

5. Lack of Certification and Documentation

Unlike transactions with certified gold dealers, purchases at flea markets and farmer’s markets may not come with proper documentation, such as certificates of authenticity or receipts. This lack of paperwork can make it challenging to verify the gold’s purity, origin, or value. It’s important to ask the seller questions about the gold’s source, age, and any available documentation. If possible, seek out vendors who provide some form of assurance or testing on-site.

6. Inspecting the Gold’s Condition and Quality

When buying gold at these markets, always inspect the items carefully. Look for any visible signs of wear, damage, or repairs, especially in gold jewelry. Pay attention to markings, such as karat stamps (like 14K, 18K, etc.) or hallmarks, which can provide clues about the gold’s purity. However, remember that these markings are not always a guarantee of authenticity, so additional testing may be necessary.

7. Building Trust with Sellers

Frequenting the same flea markets or farmer’s markets can help you build relationships with trusted sellers. Establishing rapport and getting to know the vendors can provide valuable insights into their inventory and business practices. Trusted sellers may even offer you first access to new items or provide discounts, creating opportunities for repeat business and better deals over time.

8. Bring Cash and Be Prepared to Walk Away

Many sellers at flea markets and farmer’s markets prefer cash transactions, which can give you more bargaining power. However, it’s essential to have a predetermined budget and be prepared to walk away if you are not confident in the item’s authenticity or if the price seems too high. Do not let pressure or impulse drive your decision—buying gold should always be a careful and informed choice.

The Gold Buying Facts . . .

Buying gold at flea markets and farmer’s markets can be a rewarding experience, offering opportunities for bargains, unique finds, and a personalized buying experience. However, it also comes with risks, including counterfeit gold and lack of certification. By being cautious, informed, and prepared, you can make smart purchases that add value to your gold holdings and protect your investment during difficult times.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold During Difficult Times

Why Owning Physical Gold Is Beneficial During Difficult Times

During times of economic uncertainty, political instability, or social upheaval, having tangible assets like gold can provide peace of mind and financial security. Unlike digital assets or stocks, physical gold in your possession offers a unique advantage: it is a universally accepted form of wealth that can be easily liquidated or traded when other means of transaction are limited or unavailable. Here’s why having gold in your own possession is valuable when times are tough.

1. Immediate Liquidity

One of the primary benefits of owning physical gold is its liquidity. Gold is recognized and valued globally, and it can be quickly converted into cash or traded for goods and services. Unlike other assets that may lose value during crises or become difficult to sell, gold retains its purchasing power and is always in demand. Whether you need to pay for essential goods, cover emergency expenses, or move to a new location, having physical gold can provide the liquidity you need without relying on banks or digital payment systems.

2. Protection Against Banking Failures

During economic downturns or financial crises, banks can experience significant stress, leading to restrictions on withdrawals, closures, or even failures. When these situations occur, access to your money can become severely limited. Having physical gold ensures that you have a readily available source of wealth that is not dependent on the banking system. In times of bank runs or capital controls, owning gold allows you to maintain financial independence and security.

3. Bartering Power in a Cashless Society

In extreme situations where cash becomes scarce or loses its value, gold can serve as a highly effective medium of exchange. Physical gold, especially in the form of small bars or coins, is ideal for bartering. Unlike fiat currency, which can be devalued due to hyperinflation or political decisions, gold retains its intrinsic value and can be traded for necessities such as food, medicine, or fuel. In a barter economy, having gold in your possession provides a tangible asset that is trusted and accepted worldwide.

4. Portable Wealth

Gold is a dense and portable form of wealth, making it easy to store and transport. A small amount of gold can represent a significant value, allowing you to carry substantial wealth in a compact and discreet manner. This is especially important in situations where you may need to relocate quickly or cross borders during a crisis. Unlike real estate or other fixed assets, gold is easily concealed and transported, providing a flexible and portable store of value that you can rely on wherever you go.

5. Protection from Digital Risks

In a world increasingly dependent on digital transactions, there are inherent risks, including cyberattacks, data breaches, or the shutdown of digital networks. If access to online banking or payment systems is disrupted, having gold in your possession provides a fail-safe backup. Physical gold does not rely on digital infrastructure and is immune to hacking, technical failures, or government-imposed restrictions on digital transactions.

6. Universal Acceptance Across Cultures

Gold has been valued as a form of money for thousands of years across all cultures and civilizations. Its universal recognition means that, unlike some other forms of wealth, gold is not subject to regional or cultural preferences. Whether you find yourself in a different country or dealing with people from various backgrounds, gold is universally accepted and can be used as a means of exchange, giving you more flexibility and freedom in difficult times.

7. Security and Independence

Owning physical gold offers a level of financial security and independence that other investments may not provide. Unlike stocks or bonds, which are tied to the performance of companies or governments, gold is a tangible asset that you own outright. It is not subject to counterparty risk, meaning its value is not dependent on the solvency or performance of another party. This independence is particularly important during times of economic uncertainty, when other investments may become more volatile or lose value.

The Gold Buying Facts . . .

Owning physical gold provides numerous advantages during challenging times, from offering immediate liquidity and bartering power to providing protection against digital risks and banking failures. It serves as a portable, universally accepted form of wealth that retains its value even when other assets falter. In an unpredictable world, having gold in your possession can provide the financial security, flexibility, and peace of mind needed to navigate through difficult circumstances.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Benefits of Buying Gold

Benefits of Buying Gold for Your Investment Portfolio

Investing in gold has long been regarded as a smart move for those looking to diversify and protect their wealth. Unlike stocks or bonds, gold holds intrinsic value and has been considered a reliable store of value for thousands of years. In times of economic uncertainty, political instability, or currency fluctuations, gold often shines as a safe haven for investors. Here’s why including gold in your investment portfolio could be a wise decision.

1. Hedge Against Inflation

One of the most well-known benefits of gold is its ability to act as a hedge against inflation. When inflation rises, the purchasing power of currencies tends to decline. However, gold prices generally increase when inflation is high, helping to preserve your wealth. This is because gold is priced in U.S. dollars, and its value tends to rise as the dollar weakens, making it an attractive investment during inflationary periods.

2. Portfolio Diversification

Diversification is a key principle of investing, aimed at reducing risk by spreading investments across different asset classes. Gold’s unique position as both a commodity and a monetary asset makes it an excellent choice for diversification. It often has a low or negative correlation with other asset classes, such as stocks and bonds. This means that when those investments decline in value, gold can often maintain its value or even increase, balancing your portfolio’s overall risk.

3. Liquidity and Global Acceptance

Gold is one of the most liquid assets available to investors. It can be quickly converted into cash, no matter where you are in the world. This universal acceptance is critical in times of financial crisis or geopolitical uncertainty when other assets might be harder to sell or convert. Owning physical gold, such as bars or coins, ensures that you have a universally recognized form of currency that can be easily traded or sold.

4. Protection Against Currency Fluctuations

For investors dealing with multiple currencies, gold can provide protection against fluctuations in currency value. When local currencies are volatile or declining, gold prices often move in the opposite direction. This makes gold an attractive option for international investors looking to protect their wealth from unfavorable currency movements.

5. Safe Haven Asset in Times of Crisis

Gold has long been considered a “safe haven” asset. In times of economic or geopolitical turmoil, investors often flock to gold to preserve their capital. During periods of uncertainty—such as wars, financial crises, or pandemics—gold has historically retained or even increased in value, while other assets like stocks or real estate might lose value. Having gold in your portfolio can provide a sense of security and stability when markets are volatile.

6. Potential for Capital Appreciation

While gold is often considered a conservative investment, it also has the potential for capital appreciation. Gold prices have shown a significant increase over the past few decades, driven by factors like demand from emerging markets, central bank purchases, and limited supply. As global demand continues to grow, particularly from countries like China and India, the value of gold may continue to rise, offering potential gains to investors.

7. No Counterparty Risk

Unlike stocks, bonds, or other financial instruments, gold does not carry counterparty risk. It is a tangible asset that you own outright, and its value does not depend on the performance or solvency of an institution or third party. This lack of counterparty risk makes gold a particularly attractive option for risk-averse investors seeking a secure store of value.

The Gold Buying Facts is . . .

Including gold in your investment portfolio can provide numerous benefits, from hedging against inflation to offering a haven during times of crisis. Its unique properties make it a valuable asset for diversification, protection against currency fluctuations, and potential capital appreciation. As with any investment, it’s essential to consider your financial goals, risk tolerance, and market conditions. However, in a world of uncertainty, gold remains a reliable and time-tested investment choice.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold Buying Tips for 2024

Gold Buying Tips for 2024

In 2024, gold remains one of the most reliable and sought-after investments, offering a hedge against inflation, currency fluctuations, and market volatility. Whether you’re a seasoned investor or new to the precious metals market, following smart strategies is crucial. Here are the top gold-buying tips for 2024 to ensure you make informed and profitable decisions.

1. Understand Gold’s Role in Your Portfolio

Gold can be a stable asset that preserves wealth, but it’s essential to recognize that it’s not designed for short-term gains. Evaluate your portfolio and financial goals. Gold typically serves as a long-term investment to diversify risk and protect against inflation. Experts suggest allocating 5-10% of your portfolio to gold for balanced growth and security.

2. Stay Informed on Market Trends

The gold market can fluctuate based on economic indicators, geopolitical events, and changes in currency values. For 2024, keep an eye on factors like inflation rates, interest rates, and global political tensions. Subscribe to reliable sources for gold market news, such as market analysis websites, financial news platforms, or investment newsletters, to stay updated.

3. Buy Physical Gold Wisely

There are several ways to buy gold, but purchasing physical gold—whether in coins, bars, or bullion—remains a popular option. Here are key things to consider:

- Weight and Purity: Ensure the gold you buy is of high purity (e.g., 99.99% pure gold) and sold in weights that match your investment goals.

- Mint Marks: Check for recognizable and reputable mint marks such as those from the U.S. Mint or Royal Canadian Mint to guarantee authenticity.

- Secure Storage: Plan for secure storage solutions such as home safes, safety deposit boxes, or insured vault services.

4. Diversify Your Gold Holdings

Don’t put all your gold into one form. Consider diversifying your holdings between physical gold, gold ETFs (Exchange-Traded Funds), and mining stocks. Physical gold is tangible and easy to liquidate, while ETFs offer convenience without the need for storage. Mining stocks provide indirect exposure to gold and can yield returns based on company performance.

5. Research Reputable Sellers

In 2024, online gold buying platforms have made it easier to purchase gold, but not all sellers are created equal. Avoid scams by researching the reputation of the gold dealer. Look for:

- Transparent Pricing: Reputable dealers provide real-time pricing, based on the current spot price of gold, with clear premiums and fees.

- Customer Reviews: Check customer feedback on platforms like Trustpilot or the Better Business Bureau.

- Buyback Policies: Ensure the seller offers a buyback policy so you can sell your gold back to them with ease if needed.

6. Avoid Emotional Buying

Gold can be an emotional investment, especially during times of crisis when prices spike. However, buying gold out of fear or panic during these periods can lead to overpaying. Stick to a well-thought-out strategy rather than chasing short-term market swings. Timing your purchases when the market is calm can help you avoid inflated prices.

7. Know the Tax Implications

Gold is considered a collectible by the IRS, and its sale is subject to capital gains tax. In 2024, familiarize yourself with the tax rules governing gold investments in your country, especially if you plan on selling any of your holdings. Work with a tax advisor to minimize your tax liability and maximize your after-tax returns.

8. Consider Gold in Retirement Accounts

If you’re looking to incorporate gold into your retirement strategy, 2024 offers more options than ever. You can invest in physical gold through a self-directed IRA, which allows you to diversify your retirement portfolio. Make sure to comply with the IRS rules regarding gold IRAs, particularly regarding the type of gold that qualifies (e.g., IRS-approved coins and bullion).

9. Be Aware of Gold Scams

Unfortunately, gold scams remain a concern for investors. Common scams in 2024 include:

- Fake or adulterated gold bars and coins.

- Overpriced numismatic coins sold as rare investments.

- Phony gold investment schemes offering “guaranteed” returns.

To avoid falling victim to scams, work only with licensed and reputable dealers, ask for authenticity certificates, and verify all claims made by the seller.

The Gold Buying Facts . . .

Gold continues to be a valuable and strategic investment in 2024. By staying informed, being cautious of scams, diversifying your holdings, and buying from reputable sources, you can build a solid foundation for wealth preservation and growth. Whether you’re buying gold for protection against market uncertainty or as a hedge against inflation, the key is to approach the market with careful planning and a clear understanding of your financial goals.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Selling Jewelry Business

Selling Jewelry: As Easy as having a source

The rise of self-business opportunities has given entrepreneurs the chance to create thriving businesses with minimal investment. Some source companies built a strong reputation for selling trendy jewelry through direct sales, social media, and live-streamed events. But did you know that selling plated jewelry can be just as easy and lucrative?

Whether you are new to the self-business world or looking to expand your offerings, selling plated jewelry provides an excellent opportunity to tap into a growing market.

Why Plated Jewelry?

Plated jewelry is an affordable alternative to solid gold or silver pieces, offering a stylish and budget-friendly option for customers who want the look of luxury without the high price tag. This type of jewelry involves coating a base metal—such as copper or brass—with a thin layer of gold, silver, or another precious metal.

Because it’s less expensive to produce, plated jewelry allows you to offer a wide variety of styles at accessible price points. And since the demand for affordable fashion accessories continues to grow, selling plated jewelry can be a lucrative venture for those looking to start or expand a self-business.

The Business Model

Selling jewelry has built its business models around the concept of fun, engaging direct sales. One source, for example, hosts live-streamed “jewelry reveals,” where customers purchase surprise items and watch as the pieces are unwrapped in real-time. Another source follows a similar model, encouraging community and engagement through unique product offerings and personal connections with customers.

These companies have shown that selling jewelry doesn’t have to be a traditional retail experience—it can be dynamic, interactive, and highly social. Entrepreneurs who join these sources often use social media platforms like Facebook or Instagram to host live events, market their products, and build a loyal customer base.

Selling Your Jewelry Using the Same Approach

Selling your creative jewelry can be just as exciting and easy as the source models mentioned above. Here’s how you can apply similar strategies to build your own business:

- Host Live Jewelry Reveals Just like the source example, you can create excitement around your jewelry by hosting live-streamed events. Customers love the thrill of a mystery, so consider offering surprise jewelry reveals where they purchase a package without knowing exactly what’s inside. The anticipation and engagement keep viewers coming back for more.

- Leverage Social Media Social media platforms are key to building a successful jewelry business. You can showcase your unique creative jewelry pieces through posts, stories, and live videos. Use platforms like Instagram, Facebook, and TikTok to create content that highlights the quality and beauty of your items, while also engaging directly with your audience.

- Build a Community One of the reasons these sources have been so successful is that they cultivate strong, loyal communities. By creating a space where customers can connect, share their experiences, and celebrate new jewelry pieces, you build a network of repeat buyers. Encourage customers to share photos of themselves wearing your unique jewelry and feature them on your social media accounts.

- Offer Affordable Luxury Your creative jewelry allows customers to experience the look of gold, silver or rose gold without breaking the bank. Make affordability a key selling point of your business. You’ll attract customers who want beautiful pieces at reasonable prices, much like the examples sources do with their product lines.

- Create a Personalized Experience Personalization is another key factor in the success of these self-business models. Offer customers the chance to choose specific styles, colors, or designs that resonate with their tastes. This extra touch makes each sale feel special and customized, increasing customer satisfaction and loyalty.

Why Selling Your Jewelry Business Works

Selling your creative jewelry offers several advantages:

- Low Initial Investment: Your creative jewelry is generally much cheaper to produce than solid gold or silver pieces, making it an affordable inventory to start with.

- Wide Appeal: Your creative jewelry caters to a broad audience, from young fashionistas to adults seeking elegant accessories.

- High-Profit Margins: Since your jewelry costs less to produce, you can price your products at a competitive rate while still enjoying healthy profit margins.

- Endless Style Options: From minimalist designs to bold statement pieces, your jewelry can be tailored to every trend and personal style, making it easy to keep your inventory fresh and exciting.

The Gold Buying Facts . . .

If you’ve been considering joining a self-business model like the source exampled here or selling your jewelry creations you can have the same flexibility, excitement, and financial rewards. By using similar sales techniques—like live reveals, social media engagement, and community building—you can turn your love of fashion into a successful business venture. The accessibility and wide appeal of your creative jewelry make it a fantastic option for entrepreneurs looking to break into the market with minimal risk and high potential.

YOU can DO IT! … Or invest in gold coins and bars . . .

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Investment Returns on Gold

Investment Returns on Gold: Is It a Profitable Investment?

Gold has long been seen as a safe-haven investment, offering stability during times of economic uncertainty. But how does gold perform as an investment over time? What kind of returns can investors realistically expect? Understanding the potential returns on gold is essential for anyone considering it as part of their investment portfolio.

The Nature of Gold as an Investment

Unlike stocks or bonds, gold does not generate income in the form of dividends or interest. Its value is purely tied to its price appreciation, which can fluctuate based on various economic factors such as inflation, currency fluctuations, and global political tensions. Because of this, gold often serves as a store of value rather than a source of regular income.

Historically, gold tends to perform well when other assets, like stocks or real estate, are struggling. This inverse relationship is why gold is often referred to as a “hedge” against market volatility. But how does gold perform over the long term?

Historical Performance of Gold

Over the past few decades, gold has shown a solid track record of returns, though these returns can vary widely depending on the time frame:

- 1970s: The 1970s were a golden era for gold investors. Gold prices soared from $35 per ounce at the start of the decade to nearly $850 by 1980. This rise was largely driven by inflation and geopolitical tensions, offering massive returns for those who had invested early.

- 1980s-1990s: After peaking in 1980, gold entered a bear market for much of the next two decades. Inflation was tamed, and economic conditions stabilized, which reduced gold’s appeal as a hedge. During this period, stocks vastly outperformed gold.

- 2000s: The 2000s saw another resurgence in gold prices. From 2000 to 2011, gold prices climbed from around $270 per ounce to over $1,900 per ounce, spurred by the 2008 financial crisis, economic uncertainty, and rising inflation concerns. Investors who held gold during this period saw substantial returns.

- 2010s: After peaking in 2011, gold prices experienced a pullback, hovering between $1,100 and $1,400 for several years. However, by the late 2010s, gold began to rise again due to geopolitical instability and trade tensions.

- 2020s: The COVID-19 pandemic led to another surge in gold prices, pushing it to over $2,000 per ounce in 2020 as investors sought safety during global uncertainty. While prices have fluctuated since then, gold remains a valuable asset in a diversified portfolio.

Long-Term Returns on Gold

On average, gold has returned around 6-7% annually over the past several decades. However, this figure can be misleading because gold’s performance is highly cyclical. For example, investors who bought during gold’s peak in the early 1980s would have had to wait nearly 30 years for significant returns. On the other hand, those who invested in the early 2000s saw impressive growth in just over a decade.

Gold’s long-term performance tends to lag behind stocks but outpaces inflation, making it a solid store of value during periods of economic turmoil. While it may not generate the same level of returns as equities, it provides a hedge against market downturns and preserves wealth.

Factors Affecting Gold Investment Returns

Several factors can influence the returns on gold investments:

- Inflation: Gold is often used as a hedge against inflation. When inflation rises, the value of paper currency tends to fall, and gold prices typically increase as investors seek tangible assets that retain value.

- Currency Fluctuations: Gold is typically priced in U.S. dollars. A weaker dollar often leads to higher gold prices, while a stronger dollar can suppress gold prices.

- Economic and Political Instability: Global uncertainty often drives up demand for gold. Wars, political unrest, and economic crises can lead to spikes in gold prices as investors flock to safety.

- Interest Rates: Lower interest rates make gold more attractive since it offers no yield, but high interest rates can reduce demand for gold in favor of income-generating assets like bonds.

Gold vs. Other Investments

Compared to stocks, real estate, or bonds, gold has unique advantages and disadvantages. While it may not offer the high returns that stocks can generate during bull markets, it provides stability that can protect against market downturns. Here’s a comparison:

- Gold vs. Stocks: Stocks typically provide higher long-term returns through capital gains and dividends. However, they are subject to more volatility and greater risk during economic recessions. Gold, on the other hand, acts as a safeguard during market crashes.

- Gold vs. Bonds: Bonds generate a steady income through interest payments. Gold lacks this income aspect but can appreciate in value during inflationary periods when bonds may lose real purchasing power.

- Gold vs. Real Estate: Real estate provides both capital appreciation and rental income, but it is illiquid and requires maintenance. Gold is liquid and can be easily sold, making it an attractive option for those seeking quick access to funds.

The Gold Buying Facts . . . Gold is a Good Investment

Gold can be a valuable component of a diversified investment portfolio, particularly for those seeking to hedge against economic uncertainty, inflation, and currency fluctuations. While it may not generate the same level of returns as stocks, it provides a safe haven during periods of volatility and economic downturns. Investors should consider their risk tolerance, financial goals, and the broader market conditions when deciding whether to invest in gold.

Ultimately, gold’s role as a long-term store of value and a hedge against risk makes it a compelling investment for those looking to preserve wealth and protect their portfolios from unforeseen events.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold Buying and Selling Mistakes

Beware of Gold Buying and Selling Scams: How to Avoid Common Traps

When it comes to gold transactions, accuracy is key. Whether you’re buying or selling gold, even the slightest misunderstanding of weight measurements can lead to costly mistakes. Unfortunately, scammers often take advantage of this, using tactics that confuse buyers and sellers alike. One of the most common pitfalls involves misinterpreting measurements such as grams vs. grains and troy ounces vs. regular ounces.

To protect yourself, here’s a breakdown of common scams and mistakes to be aware of.

1. Grams vs. Grains

A particularly deceptive trick is confusing grams with grains. These two measurements sound similar but differ significantly in weight:

- 1 gram = 15.43 grains

- 1 grain = 0.065 grams

Scammers may label gold as “grains” rather than grams to make it seem like you’re getting more gold than you actually are. For example, 20 grains of gold is far less than 20 grams, but the untrained eye might not catch the difference, leading to significant overpayment.

2. Troy Ounce vs. Regular Ounce

Another common scam is exploiting the difference between troy ounces and regular (avoirdupois) ounces:

- 1 troy ounce = 31.1 grams

- 1 regular ounce = 28.35 grams

Gold is always measured in troy ounces, but some sellers might try to trick buyers by quoting prices in regular ounces. If you mistakenly think you’re buying a troy ounce when you’re actually buying a regular ounce, you’re getting less gold for your money. This scam is often seen in online marketplaces or shady dealers.

3. Low Purity Gold

Gold purity is another factor scammers manipulate. They may sell gold jewelry or coins labeled as “gold” without specifying the karat or purity. Commonly, items marketed as gold may turn out to be gold-plated or made from low-karat gold mixed with other metals.

A genuine 24K gold item is pure, but if an item is 18K or 14K, it contains a percentage of other metals, reducing its value. Always verify the purity of gold using reputable assays or testing methods to avoid being deceived.

4. Counterfeit Gold Bars and Coins

Counterfeit gold bars and coins are becoming increasingly sophisticated, making it difficult for inexperienced buyers to detect them. Scammers may create fake bars or coins using cheaper metals plated with a thin layer of gold, mimicking the appearance and weight of genuine items.

Some fakes even come with forged certificates of authenticity, which can further mislead buyers. Always buy from reputable dealers who provide guarantees and verify authenticity with professional services.

5. Misleading Weight Descriptions

Another tactic scammers use is misrepresenting the weight of gold items. They may list items by total weight, including non-gold components such as chains, clasps, or embedded stones. While the total weight might seem attractive, the actual gold content could be much lower than you realize.

Always check the weight of the gold alone, excluding any additional materials. This will give you a clearer understanding of the item’s true value.

6. Phony Gold Investment Schemes

Gold investment scams promise high returns with little risk. These schemes often involve convincing investors to buy shares in non-existent gold mines or to purchase gold at highly inflated prices. Victims are lured in with promises of secure wealth but end up losing their money when the fraudulent operations collapse.

Research any investment opportunities thoroughly, verifying the legitimacy of the companies and dealers involved. Be wary of unsolicited offers or pressure to act quickly.

How to Protect Yourself from Gold Scams

- Know Your Measurements: Understanding the difference between grams, grains, troy ounces, and regular ounces is critical when buying or selling gold. Always double-check the measurements used in any transaction.

- Verify Purity: Ensure that any gold you buy is properly marked with its karat or fineness. Use reputable sources to test gold purity if needed.

- Buy from Reputable Dealers: Only purchase gold from trusted and verified dealers. Reputable sellers will provide certifications and guarantees for the gold they sell.

- Be Wary of Unrealistic Offers: If a deal seems too good to be true, it probably is. Always be skeptical of offers that promise unusually high returns or significant discounts.

- Check for Counterfeits: Use professional services to authenticate gold items, especially when dealing with large purchases such as gold bars or coins.

The Gold Buying Facts . . .

Gold buying and selling can be lucrative, but staying informed and vigilant is crucial. Scammers are always looking for ways to take advantage of unsuspecting buyers, but by understanding the most common tricks and pitfalls—like confusing grams with grains or troy ounces with regular ounces—you can protect yourself. Always prioritize knowledge, caution, and reliable sources when navigating the gold market.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Importance of Gold Weight

The Importance of Gold Weight in Buying and Selling Gold

When it comes to buying and selling gold, weight is one of the most critical factors that determine its value. Gold weight plays a significant role in pricing, purity assessment, and investment decisions. Whether you’re purchasing gold jewelry, bullion, or coins, understanding how gold weight affects your transaction is key to making informed choices.

Why Gold Weight Matters

1. Direct Impact on Price

The price of gold is usually quoted per ounce, gram, or kilogram, depending on the region. The heavier the gold item, the more it will cost. For instance, a 10-gram gold bar will be priced higher than a 1-gram bar due to the amount of gold content it holds.

Prices fluctuate based on the current spot price of gold, but the weight always directly correlates to the final price. This is why accurate measurements of gold are essential in any transaction.

2. Gold Purity and Weight

The purity of gold is often measured in karats or fineness, and this affects its weight-to-value ratio. Pure gold (24K) is softer and less dense than lower karat gold mixed with other metals. However, the weight of pure gold is higher in value per gram than lower karat gold. When buying gold, you must consider both the weight and the purity to assess the true value of the item.

3. Investment Decisions

For investors, the weight of gold plays a pivotal role in their portfolios. Gold bars, coins, and other forms of bullion come in various weights, such as 1 ounce, 10 grams, or 1 kilogram. Investors often prefer heavier gold items because they offer more value in a single purchase, although smaller weights can be more liquid and easier to sell.

4. Liquidity and Resale Value

Gold weight also affects how easily an item can be sold or traded. Heavier gold bars or larger coins might be harder to liquidate compared to smaller denominations. For instance, a 1-kilogram gold bar requires a buyer willing to make a significant investment, while a 10-gram bar or a 1-ounce coin can be sold more easily to a broader audience.

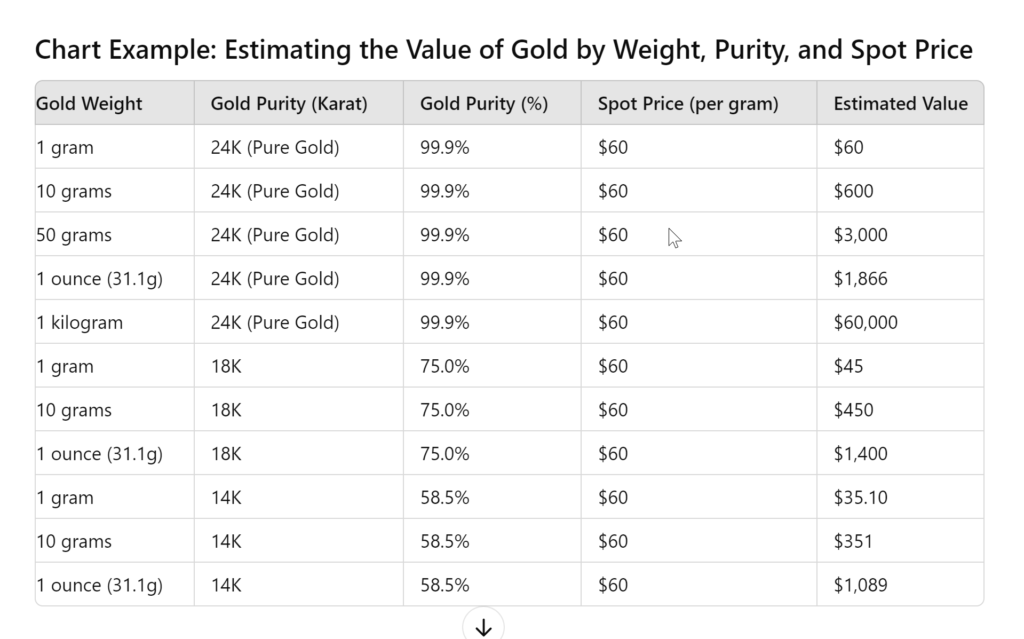

Understanding Gold Weight: An Example

To illustrate the importance of gold weight, refer to the chart below, which shows how gold weight affects its value at varying purity levels and spot prices. By using this chart, buyers and sellers can estimate the potential value of gold items based on their weight:

How to Read the Chart:

- Gold Weight: The mass of the gold item.

- Gold Purity: Expressed in karats and percentage. 24K is pure gold, while lower karats are gold mixed with other metals.

- Spot Price: The current market price for 1 gram of pure gold.

- Estimated Value: The value of the gold item is based on its weight and purity.

Example Use Cases:

- If you have a 1-ounce, 24K gold coin, you can estimate its value by multiplying the weight by the spot price ($60/gram) to get $1,866.

- If you’re selling a 10-gram 18K gold necklace, its estimated value will be $450.

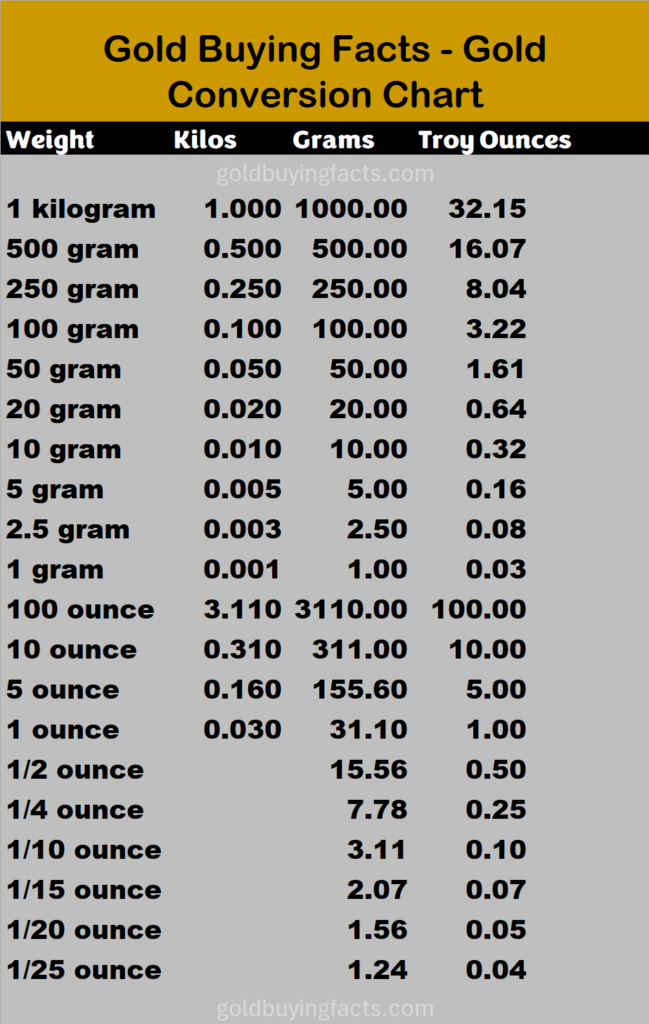

Weight Conversion Chart:

The Gold Buying Facts . . .

The weight of gold is an essential factor in determining its value and liquidity. Whether you’re purchasing gold for investment or personal use, understanding the relationship between gold weight, purity, and market price can help you make smarter, more profitable decisions. Be sure to weigh your options carefully and refer to accurate measurements and pricing guides when buying or selling gold.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold is More Expensive Than Silver

Why Gold is More Expensive Than Silver

When considering precious metals, gold and silver often come to mind as the most valuable. However, gold consistently holds a higher price than silver. This price disparity is due to a variety of factors, from rarity and industrial demand to historical significance and market dynamics. Here’s a deeper look at why gold is more expensive than silver.

1. Rarity and Availability

The most obvious reason gold is more expensive than silver is its scarcity. Gold is rarer in the Earth’s crust than silver. According to estimates, for every ounce of gold mined, approximately 19 ounces of silver are extracted. This scarcity naturally drives up the price of gold compared to silver, as basic supply-and-demand economics dictate that rarer commodities command higher prices.

2. Mining and Production Costs

The process of mining gold is generally more expensive and labor-intensive than silver extraction. Gold deposits are often located in more remote regions and require extensive exploration and excavation. Additionally, the refining process for gold can be more complex, increasing the overall cost of production. These increased costs are reflected in the price of gold.

3. Market Demand

While both metals are used for investment and industrial purposes, the demand for gold as a store of value and in jewelry far outweighs that of silver. Gold is widely recognized as a hedge against inflation, economic uncertainty, and currency fluctuations. Its universal appeal as a symbol of wealth and stability means that there is consistently strong demand for gold across the globe.

Silver, on the other hand, is often seen as a secondary investment. While it is also a store of value, silver’s industrial applications in electronics, solar panels, and other technologies temper its price. This industrial demand can fluctuate, leading to more price volatility for silver than for gold, which is more stable due to its broader investment base.

4. Historical Significance and Cultural Value

Gold has held a special place in human history for thousands of years, being used as currency, in trade, and in the creation of precious artifacts. Its association with wealth, power, and status has been deeply ingrained across many cultures. This long-standing historical and cultural significance enhances gold’s value beyond its physical properties.

Silver has also been valuable throughout history, often used as currency and in jewelry. However, it has never carried the same weight in cultural or symbolic terms as gold. This difference in historical value contributes to the higher price of gold.

5. Monetary and Financial Influence

Gold is often held by central banks and governments as a part of their reserves, signifying its importance in the global monetary system. Central banks buy and sell gold to manage their country’s currency stability, further boosting its price. Silver does not play the same role in modern monetary systems, keeping its value lower than gold.

6. Liquidity and Investment Vehicles

Gold offers more liquidity than silver in global markets. It is easier to buy and sell gold in large quantities without affecting the market price significantly, making it a preferred choice for institutional investors. Additionally, there are various investment vehicles for gold, including ETFs, gold stocks, futures, and physical bullion. While silver also has investment products, they are not as widely traded or valued as gold, contributing to the price gap between the two metals.

The Gold Buying Facts . . .

While both gold and silver are precious metals with significant value, gold’s rarity, higher production costs, historical and cultural importance, and stronger global demand make it more expensive. Silver is valuable in its own right, especially with its diverse industrial applications, but it remains a more volatile and less coveted metal in comparison to gold.

When considering investments in precious metals, understanding these factors can help you make informed decisions based on your financial goals and the market conditions. Whether you choose gold, silver, or a mix of both, each metal offers its unique benefits.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold Top Gift

Gifting Gold Coins to Top Executives: A Timeless Gesture of Appreciation

When it comes to recognizing top executives, business leaders often seek meaningful and distinguished gifts that reflect the recipient’s value to the company. While bonuses and other financial incentives are standard, gifting gold coins provides a unique and timeless expression of appreciation. Gold coins carry intrinsic value, a sense of prestige, and can serve as a symbol of lasting success. In this article, we’ll explore why gold coins are the perfect gift for top executives and how they can create a lasting impact.

Why Gold Coins for Top Executives?

For businesspeople aiming to make a profound statement, gold coins offer a gift that speaks of success, respect, and the recognition of exceptional leadership. Here are some key reasons why gold coins make an ideal gift for executives:

- Symbol of Achievement: Gold has long been associated with excellence and achievement. Gifting a gold coin is a tangible representation of the recipient’s hard work, leadership, and contribution to the success of the business.

- A Lasting Investment: Unlike many gifts that fade over time, gold coins retain and often increase in value. This makes them not only a thoughtful gesture but also a practical investment in the recipient’s future.

- Exclusivity and Prestige: Gold coins, particularly those with historical or cultural significance, convey a sense of exclusivity. These are not everyday gifts; they are reserved for individuals who have truly made a significant impact.

Choosing the Right Gold Coin for Executives

Selecting the right gold coin to gift a top executive requires thought and consideration. The coin should reflect the recipient’s status and symbolize the level of respect and gratitude being extended.

- American Gold Buffalo: With its striking design and high gold purity (99.99%), the American Gold Buffalo is a premium gift that conveys elegance and prestige, perfect for high-ranking executives.

- British Gold Sovereign: Known for its royal heritage, the British Gold Sovereign is a classic coin that embodies power and leadership, making it an ideal choice for executives who exemplify these qualities.

- Commemorative Coins: Some companies opt to create custom gold coins that commemorate significant achievements, anniversaries, or milestones within the organization. These coins can be tailored to celebrate the executive’s specific contributions, adding a personal touch.

The Value of Gifting Gold Coins

Gifting gold coins to top executives goes beyond a mere gesture of appreciation; it creates a lasting bond between the giver and the recipient. Here’s how these gifts can add value in a corporate setting:

- Strengthening Relationships: A gold coin is a thoughtful, personal gift that transcends the typical corporate reward. It creates a sense of lasting connection, showing the executive that their efforts are recognized and valued on a deeper level.

- Fostering Loyalty: Executives who receive gold coins as gifts may feel more closely aligned with the company’s goals and culture. The enduring nature of gold reflects the long-term commitment the company has to its leadership.

- Marking Milestones: Gifting a gold coin to an executive during a key career milestone—such as a major deal, retirement, or a significant company achievement—solidifies the moment in time and provides a lasting reminder of their contributions.

Personalized Presentations

The presentation of a gold coin is as important as the coin itself. A well-presented coin in a high-quality display box, complete with a personalized inscription, enhances the significance of the gift. Businesses may also choose to include a certificate of authenticity or a custom message that reflects the executive’s contributions to the company.

Some companies even engrave the coin with the executive’s name, the company logo, or the date of a significant achievement. This level of personalization elevates the gift from being merely valuable to being truly meaningful.

The Gold Buying Facts . . .

Gold coins are a unique and powerful way for business leaders to show appreciation for top executives. These precious gifts carry not only monetary value but also a deep sense of respect, admiration, and recognition. By gifting gold coins, businesses can create a lasting impact, strengthen relationships, and celebrate the outstanding achievements of their leadership teams. In an age where digital transactions and impersonal rewards often dominate, a gold coin provides a tangible, enduring symbol of success—one that resonates long after it is given.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gifting Gold Coins

Mint Mark on Gold Coins

The U.S. Mint Mark on Gold Coins: A Guide for Collectors and Investors

The U.S. Mint mark is a small yet crucial detail found on gold coins that signifies the location where the coin was produced. For collectors and investors alike, understanding mint marks adds depth to appreciating gold coins, as it highlights historical significance, rarity, and even value. In this article, we’ll explore the U.S. Mint marks, how they are used on gold coins, and their importance in the numismatic world.

What is a Mint Mark?

A mint mark is a letter or symbol placed on a coin to identify which U.S. Mint facility produced the coin. The United States Mint operates various branches, each with its own specific letter or symbol, typically located beneath the year on the coin’s obverse or reverse side.

U.S. Mint Locations and Their Marks

Here’s a list of the U.S. Mint locations and their corresponding mint marks:

- Philadelphia (P): The Philadelphia Mint is the original and oldest mint facility, opened in 1792. It originally did not place a mint mark on coins but began using the letter “P” in 1980 for gold coins.

- Denver (D): Opened in 1906, the Denver Mint is known for producing a vast quantity of circulating coins, including gold coins. Its mint mark is “D.”

- San Francisco (S): The San Francisco Mint, established in 1854, is known for minting proof coins. Gold coins from San Francisco are marked with an “S.”

- West Point (W): Primarily known for producing precious metal coins such as gold and silver, the West Point Mint was established in 1937. Its mint mark is “W.”

- New Orleans (O): The New Orleans Mint, operational from 1838 to 1909, produced various U.S. coins, including gold. Its mint mark is “O.”

- Carson City (CC): Carson City Mint, which operated between 1870 and 1893, is particularly famous for its limited production of gold coins. Coins from this mint bear the “CC” mint mark and are highly sought after by collectors.

Why Do Mint Marks Matter?

Mint marks hold significant value for several reasons:

- Rarity: Certain mints, like Carson City and New Orleans, produced gold coins for only a limited period, making coins with their marks rarer and more valuable. Collectors often pay a premium for these coins.

- Historical Significance: Mint marks provide insight into the history of coin production. For example, the “CC” mark from Carson City evokes images of the Old West and Nevada’s booming silver and gold mining era.

- Authentication and Grading: Mint marks are essential for authenticating a coin and determining its value. When grading a coin, a professional grader considers the mint mark along with other factors like condition, rarity, and historical relevance.

Collecting Gold Coins by Mint Mark

Collecting gold coins based on their mint marks can be a rewarding experience. Some collectors focus solely on coins from a specific mint, while others seek to collect the same coin from multiple mints. For instance, a collector might aim to gather a set of American Eagle gold coins with mint marks from Philadelphia, Denver, and West Point.

Certain gold coins are more popular among collectors, including:

- Saint-Gaudens Double Eagles: Often regarded as one of the most beautiful coins, these $20 gold pieces were produced between 1907 and 1933, featuring mint marks from Philadelphia, Denver, and San Francisco.

- Liberty Head Gold Coins: These coins, produced from the mid-1800s to the early 1900s, feature mint marks from several mints, including New Orleans and Carson City.

U.S. Mint and Modern Gold Coinage

Today, the U.S. Mint continues to strike gold coins for collectors and investors, including popular bullion coins such as the American Gold Eagle and American Gold Buffalo. These modern coins are typically produced at the West Point Mint and bear the “W” mint mark, though coins from Philadelphia and Denver also exist.

The mint mark on these coins continues to be a hallmark of authenticity and quality, reassuring buyers that their gold coins are genuine U.S. Mint products.

The Gold Buying Facts . . .

Understanding U.S. Mint marks on gold coins adds an extra layer of knowledge for collectors and investors. These small letters tell a bigger story—one of history, rarity, and value. Whether you’re hunting for a rare Carson City gold piece or building a modern collection of American Eagles, the mint mark remains a crucial detail in the numismatic journey.

By knowing the significance of each U.S. Mint mark, you can make more informed decisions when buying gold coins and enjoy the rich heritage behind these precious metal treasures.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold Can Fund Your Golden Years

How Gold Can Fund Your Golden Years After Retirement

As you approach retirement, securing your financial future becomes a top priority. While stocks, bonds, and real estate are common choices for retirement investments, gold offers a unique and often overlooked opportunity. Investing in gold can provide a hedge against inflation, diversify your portfolio, and offer a reliable store of value that could help you comfortably fund your golden years. In this article, we’ll explore how gold can play a pivotal role in securing your retirement and ensuring long-term financial stability.

The Timeless Appeal of Gold

Gold has been valued for thousands of years as a symbol of wealth, stability, and security. Unlike paper currency, gold has intrinsic value and has proven to maintain its worth during times of economic uncertainty. Its limited supply and universal demand ensure that it remains a safe haven for investors, especially those looking to preserve wealth during retirement.

Gold as a Hedge Against Inflation

One of the biggest threats to retirement savings is inflation. Over time, inflation erodes the purchasing power of traditional investments like cash and bonds. Gold, however, tends to rise in value as inflation increases. This makes gold a powerful tool for protecting your retirement savings from the risks of rising prices and economic instability. By allocating a portion of your retirement portfolio to gold, you can help offset the negative effects of inflation and preserve your wealth.

Portfolio Diversification

Diversifying your retirement portfolio is key to minimizing risk. When you invest in a variety of assets, you reduce your exposure to market volatility. Gold offers an excellent way to diversify because it often moves independently of traditional asset classes like stocks and bonds. During economic downturns, gold prices tend to rise, providing a safety net for your retirement savings. By incorporating gold into your retirement plan, you can reduce the overall risk to your portfolio and increase your financial security.

Gold as a Store of Value

Unlike stocks or real estate, which can be volatile, gold has historically retained its value over the long term. Its rarity and demand ensure that gold remains a valuable asset, even in times of financial crisis. This makes gold a reliable store of value for retirees who want to preserve their wealth and pass it on to future generations.

Different Ways to Invest in Gold

Investing in gold for your retirement can be done in various ways. Here are a few options to consider:

- Physical Gold: You can buy gold coins or bars and store them in a secure vault or at home. This provides direct ownership and the assurance that your investment is tangible.

- Gold IRAs: A Gold Individual Retirement Account (IRA) allows you to invest in gold while enjoying the tax benefits of a traditional IRA. This is an attractive option for retirees who want to grow their wealth while deferring taxes.

- Gold ETFs: Exchange-Traded Funds (ETFs) offer exposure to gold without the need to physically own it. These funds track the price of gold and can be bought and sold like stocks, offering liquidity and convenience.

- Gold Mining Stocks: By investing in companies that mine gold, you can gain indirect exposure to the price of gold. While more volatile than physical gold, mining stocks offer the potential for higher returns.

Planning for a Golden Future

When planning for retirement, it’s essential to think long-term. Gold’s stability, inflation-hedging properties, and diversification benefits make it an excellent asset to include in your retirement strategy. By carefully considering your options and balancing gold with other investments, you can build a robust retirement portfolio that will support you throughout your golden years.

The Gold Buying Facts . . .

Gold has proven time and again to be a reliable investment for those seeking security and stability. Incorporating gold into your retirement planning can protect your wealth, diversify your investments, and safeguard your financial future. As you prepare for retirement, consider how gold can be key in funding your golden years, providing peace of mind and financial freedom.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Fort Knox Gold

The Legend of Fort Knox Gold

Introduction

Fort Knox, a name synonymous with security and wealth, stands as one of the most secure places on Earth. Located in Kentucky, the United States Bullion Depository, more commonly known as Fort Knox, houses a large portion of the U.S. government’s gold reserves. This impenetrable vault has sparked myths, intrigue, and controversy for decades, leaving many to wonder—just how much gold is really stored there?

The History of Fort Knox

Fort Knox was built in 1936, during the Great Depression, as a safe location to store the nation’s gold. The U.S. had moved off the gold standard, but the reserves continued to be a critical part of the country’s wealth. Since its creation, the depository has served as the fortress for the U.S. gold reserves, holding a substantial amount of gold at its peak—over 649.6 million ounces.

Fort Knox Today

Today, the facility holds around 147.3 million ounces of gold, making it one of the largest gold repositories in the world. However, despite its immense wealth, Fort Knox is not open to the public, and few have ever been inside. The last official visit was in 1974, leading to countless conspiracy theories about whether the gold is still there.

Security Measures

Fort Knox is famous for its near-impregnable security. It is surrounded by a military base, and the building itself is a fortress constructed from granite, steel, and concrete. The depository is equipped with the most advanced security technologies, including alarms, cameras, armed guards, and electronic defenses. The vault door weighs around 22 tons and can only be opened by several people who each know only a portion of the combination. Its reputation for being invincible is so solid that the phrase “as secure as Fort Knox” has entered everyday language.

The Gold Standard and Its Impact

Although the U.S. no longer operates on the gold standard, the gold at Fort Knox still plays a vital role in national and global economics. This gold underpins the nation’s monetary policy, providing a hedge against inflation, economic downturns, and financial instability. Some argue that having such vast reserves of gold helps maintain the U.S. dollar’s status as the world’s reserve currency, though debates continue about whether all the gold stored there is accounted for.

Conspiracy Theories and Mysteries

One of the most intriguing aspects of Fort Knox is the mystery surrounding it. Due to its restricted access and the government’s secrecy, various conspiracy theories have arisen over the years. Some suggest that the vaults are empty, or that foreign gold, stolen art, and other valuable assets are stored there instead. Despite numerous audits, the public remains skeptical.

The Gold Buying Facts . . .

Fort Knox remains an enduring symbol of the wealth and power of the United States. Whether it’s the mystery of what’s behind those walls or the untouchable security, Fort Knox holds a special place in American history and the global gold market. As we look to the future, its role in securing the nation’s wealth continues to be as important as ever.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Your Future with Gold

Investing in Your Future with Gold

Gold has been a symbol of wealth and security for centuries. In an uncertain financial landscape, gold remains a reliable investment choice for those seeking to secure their future. This article explores why investing in gold is a smart move and how you can start building your wealth with this precious metal.

Why Gold Is a Timeless Investment

- Historical Value:

Gold has been a store of value for over 5,000 years. Unlike paper currency or stocks, which can lose value due to inflation or market volatility, gold’s value tends to remain stable or even appreciate over time. - Inflation Hedge:

One of the key reasons to invest in gold is its ability to hedge against inflation. When the cost of living increases, gold often rises in value, protecting your purchasing power. - Diversification:

Diversifying your investment portfolio is crucial to reducing risk. Gold can act as a counterbalance to assets like stocks and bonds, often moving inversely to traditional markets.

Different Ways to Invest in Gold

- Physical Gold:

Investing in physical gold, such as coins, bars, and jewelry, provides a tangible asset that you can store securely. This can be a great long-term investment, though it requires careful storage and insurance. - Gold ETFs (Exchange-Traded Funds):

Gold ETFs allow you to invest in gold without physically owning it. These funds track the price of gold, offering an easy way to add gold to your portfolio without the need for storage. - Gold Stocks:

Investing in gold mining companies is another way to gain exposure to gold. These stocks can be more volatile than physical gold, but they offer the potential for higher returns if the company performs well. - Gold IRAs:

A gold IRA allows you to hold gold as part of your retirement savings. This tax-advantaged account can help secure your financial future by providing a diversified retirement portfolio.

When Is the Right Time to Invest in Gold?

- Market Timing:

While gold can be a stable investment, timing your entry into the market can maximize your returns. Experts often suggest buying gold during economic downturns or when inflation is on the rise. - Long-Term Perspective:

Gold is often viewed as a long-term investment. If you’re looking for quick returns, gold might not be the best option. However, for those seeking to protect their wealth over decades, gold can be a safe bet.

Risks and Considerations

- Storage and Security:

Physical gold requires secure storage, whether in a safe at home or through a professional storage service. You’ll also need to consider the costs of insurance and security. - Market Volatility:

Like all investments, gold isn’t without risk. Gold prices can fluctuate based on various economic factors, including interest rates, currency values, and geopolitical events. - Liquidity:

While gold is a highly liquid asset, converting it back into cash can sometimes involve fees, especially with physical gold. Be sure to understand the costs involved before selling your investment.

The Gold Buying Facts . . . Securing Your Future with Gold is key

Investing in gold can be a strategic way to protect and grow your wealth for the future. Whether through physical gold, ETFs, stocks, or IRAs, diversifying your portfolio with gold offers stability in uncertain times. By understanding the benefits and risks, you can make informed decisions that will contribute to a prosperous financial future.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Famous Golden Artifacts

Famous Golden Artifacts Throughout History

Gold has been a symbol of power, wealth, and divinity for millennia, shaping cultures and civilizations across the globe. Many of the most famous golden artifacts are steeped in history, representing artistic mastery, religious devotion, or royal authority. Here’s a look at some of the most renowned golden artifacts throughout history.

1. Tutankhamun’s Funeral Mask (Ancient Egypt, 14th Century BCE)

One of the most iconic treasures of Ancient Egypt, the golden mask of Pharaoh Tutankhamun, discovered by Howard Carter in 1922, is a symbol of ancient opulence. The mask, made of solid gold and inlaid with precious stones, covered the mummified face of the boy king, who ruled Egypt in the 14th century BCE. This funerary artifact is an example of the Egyptians’ belief in the afterlife, where they preserved their rulers’ bodies and adorned them with gold to ensure their divine presence in the world beyond.

2. The Golden Fleece (Greek Mythology)

Though legendary rather than physical, the Golden Fleece remains one of the most famous golden artifacts in Western mythology. It was the object of Jason’s quest in the epic story of the Argonauts. Said to be a fleece of gold hair from a divine ram, it was believed to hold magical properties and was a symbol of authority and kingship. Though mythological, the story reflects ancient societies’ obsession with gold and its perceived divine power.

3. The Gold Artifacts of the Royal Cemetery of Ur (Mesopotamia, 2600 BCE)

Unearthed from the Royal Cemetery of Ur in modern-day Iraq, the gold artifacts buried with the Sumerian elite around 2600 BCE are awe-inspiring. These items include intricate jewelry, headdresses, and ceremonial items, such as the famous Golden Lyre. These objects were buried with the dead to symbolize their wealth and importance, reinforcing gold’s status as a precious material even in the earliest civilizations.

4. The Lydian Gold Coins (Ancient Lydia, 6th Century BCE)

The invention of coinage in Lydia, located in modern-day Turkey, marked a revolutionary moment in history. The first known coins, minted by King Croesus, were made of electrum, a naturally occurring alloy of gold and silver. These coins standardized trade and commerce, with gold becoming the primary representation of wealth. Today, these Lydian gold coins symbolize the dawn of modern economics and the role of gold as a global currency.

5. The Golden Throne of King Solomon (Biblical Period)

Although the actual throne of King Solomon has never been discovered, the Bible describes it as a grand seat made of ivory and overlaid with gold. This throne symbolizes the power and wisdom of Solomon, who was considered one of the greatest kings of Israel. The golden throne became a legendary representation of wealth, divine favor, and justice in biblical history.

6. The El Dorado (South America, 16th Century)

The legend of El Dorado, the city of gold, captured the imaginations of European explorers during the 16th century. The story originated in the Andes, where native chieftains were said to cover themselves in gold dust during ceremonies. The search for this fabled city led to expeditions deep into the jungles of South America, yet no such city was ever found. El Dorado remains a symbol of the European lust for gold and the mythical allure of vast, untold wealth.

7. The Golden Buddha (Thailand, 13th Century CE)

Weighing over 5.5 tons and made entirely of solid gold, the Golden Buddha housed in Wat Traimit in Bangkok, Thailand, is one of the largest golden artifacts in the world. Originally covered in plaster to hide it from invaders, its golden core was accidentally rediscovered in the 1950s. This artifact is revered not only for its material value but also for its spiritual significance, as gold in Buddhism is associated with enlightenment and purity.

8. The Golden Crown of Vladislav Jagellon (15th Century CE)

The Crown of Vladislav Jagellon, crafted in the 15th century, was one of the most exquisite crowns in European history, worn by kings of Bohemia and Hungary. This stunning artifact, with its encrusted jewels and ornate goldwork, reflects the opulence of medieval European monarchies and their connection to divine rule through their golden regalia.

9. The Mask of Agamemnon (Ancient Greece, 16th Century BCE)

Found in a tomb at Mycenae, Greece, the Mask of Agamemnon is a funerary mask made of gold, believed to be from the 16th century BCE. Although the name is symbolic and not an actual representation of the mythological King Agamemnon, the mask is a testament to the skill and artistry of ancient Greek goldsmiths. It was discovered by Heinrich Schliemann in the 19th century and is considered one of the most famous artifacts from ancient Greece.

10. The Gold of the Incas (Peru, 15th Century CE)

The Inca Empire was rich in gold, with many of their temples, palaces, and shrines decorated in the precious metal. The most famous of these is the Coricancha (Temple of the Sun) in Cusco, which was adorned with sheets of gold. The Inca saw gold as the sweat of the sun and used it in religious rituals to honor their gods. The looting of these artifacts by Spanish conquistadors during the 16th century marked the end of the Inca’s golden era, but their legacy remains in the treasures that survived.

The Gold Buying Facts . . .

The allure of gold has transcended time and space, captivating the minds of kings, explorers, artisans, and common people alike. These golden artifacts not only symbolize wealth and power but also hold deep cultural and spiritual significance. Whether hidden away in ancient tombs, mythologized in legends, or displayed in modern museums, these treasures offer a window into humanity’s enduring fascination with this precious metal.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold in Jewelry

Gold in Jewelry: Understanding Its Appeal and Value

Gold has been a symbol of wealth, status, and beauty for thousands of years, making it one of the most popular materials used in jewelry. From ancient civilizations to modern-day designs, gold’s allure remains unmatched. But not all gold jewelry is the same. This article will explore the various types of gold used in jewelry, what they mean for value and appearance, and tips for making informed purchasing decisions.

1. Why Gold for Jewelry?

Gold’s appeal lies in its unique properties:

- Malleability: Gold is incredibly soft and can be shaped into intricate designs without breaking.

- Durability: While soft, gold is resistant to tarnish, corrosion, and rust, making it a long-lasting material for jewelry.

- Beauty: Its rich, warm color is universally flattering, making it a timeless choice for many.

These qualities make gold the ideal metal for crafting everything from delicate rings to elaborate necklaces.

2. Types of Gold Used in Jewelry

When buying gold jewelry, you’ll come across several different terms that describe the type and quality of the gold. Here’s a breakdown of the most common types:

a. Pure Gold (24K)

- Purity: 24 karat (24K) gold is 99.9% pure gold.

- Characteristics: It is bright yellow in color and very soft. While it is the purest form of gold, its softness makes it less practical for everyday jewelry as it can bend or scratch easily.

- Use in Jewelry: 24K gold is commonly used in high-end jewelry or in cultural pieces, especially in regions like India and China where pure gold is highly valued.

b. 18K Gold

- Purity: 18 karat (18K) gold contains 75% pure gold, with 25% made up of other metals like copper or silver.

- Characteristics: It is more durable than 24K gold while still retaining a rich yellow color. It strikes a balance between purity and strength, making it a popular choice for high-quality jewelry.

- Use in Jewelry: Often used in fine jewelry, engagement rings, and luxury watches.

c. 14K Gold

- Purity: 14 karat (14K) gold contains 58.3% pure gold and 41.7% other metals.

- Characteristics: More durable and affordable than 18K gold, it’s a practical option for everyday jewelry like bracelets, rings, and necklaces.

- Use in Jewelry: Commonly found in a wide range of jewelry styles due to its strength and affordability.

d. Gold-Plated Jewelry

- Purity: Gold-plated jewelry consists of a base metal (such as brass or copper) coated with a thin layer of gold.

- Characteristics: It offers the look of gold at a fraction of the cost. However, the gold layer can wear off over time, exposing the base metal underneath.