Gold B Facts

Who Invests in Gold

Who Invests in Gold? An In-Depth Look

Gold has long been considered a valuable asset, revered for its beauty, rarity, and stability. But who actually invests in gold? From everyday citizens to high-profile celebrities and even world leaders, gold is a popular choice for those looking to diversify their investment portfolios. Let’s explore the different groups of people who invest in gold and whether public figures like celebrities and the President of the United States include gold in their investment strategies.

Everyday Investors

Many everyday investors turn to gold as a way to hedge against inflation, economic instability, or currency fluctuations. Gold is often seen as a “safe haven” asset, meaning it tends to hold or increase in value during times of financial uncertainty. Individuals who are cautious about the stock market or worried about economic downturns may choose to invest in physical gold, such as coins or bars, or through financial instruments like gold exchange-traded funds (ETFs).

High Net Worth Individuals

Wealthy individuals, including business tycoons, hedge fund managers, and successful entrepreneurs, often include gold in their investment portfolios. These investors typically have more capital to invest and seek ways to protect their wealth over the long term. Gold provides a way to diversify their holdings and reduce the overall risk of their portfolios.

For high-net-worth individuals, gold is not just an investment; it’s a status symbol. Owning gold, particularly in large quantities or in rare forms like antique coins, can be seen as a display of wealth and sophistication.

Celebrities

Celebrities are known for their lavish lifestyles and diverse investment portfolios. While they often invest in real estate, stocks, and startups, many also choose to invest in gold. For some, gold is a way to preserve wealth, while for others, it may be part of a broader strategy to diversify their assets.

For example, well-known figures like Kanye West and Kim Kardashian have been reported to invest in gold. The appeal of gold to celebrities often lies in its historical value and the fact that it’s a tangible asset that can be passed down through generations. Gold’s reputation as a “safe” investment also makes it attractive to those who may want to protect their wealth from the volatility of other markets.

Central Banks and Governments

Central banks around the world hold gold reserves as a means of securing the value of their currencies. Gold is often used as a backup asset, providing stability to a country’s economy. The United States, for instance, has one of the largest gold reserves in the world, held primarily at Fort Knox and the Federal Reserve Bank of New York.

While it’s unlikely that individual government leaders, such as the President of the United States, personally invest in gold due to strict regulations and conflict of interest laws, the U.S. government itself is a significant holder of gold. The gold reserves are managed by the Treasury Department and play a crucial role in the country’s monetary policy.

Institutional Investors

Institutional investors, such as pension funds, insurance companies, and mutual funds, also invest in gold. These entities manage large sums of money and often include gold in their portfolios to balance risk. Institutional investors typically invest in gold through financial instruments like gold ETFs, futures contracts, or gold mining stocks.

Why Invest in Gold?

The reasons people invest in gold are varied, but some of the most common motivations include:

- Hedge Against Inflation: Gold has historically maintained its value over time, making it a popular choice for those looking to protect their wealth from inflation.

- Diversification: Gold often moves independently of stocks and bonds, providing a way to diversify investment portfolios and reduce overall risk.

- Crisis Commodity: During times of political or economic instability, gold tends to perform well, as it is perceived as a safe asset.

Conclusion

Gold continues to be a popular investment choice across various demographics, from everyday individuals to celebrities, institutions, and even governments. Whether it’s for wealth preservation, diversification, or as a status symbol, gold’s appeal remains strong.

If you’re considering adding gold to your investment portfolio, it’s important to understand your own financial goals and risk tolerance. Gold can be a valuable addition, but like any investment, it requires careful consideration and planning.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Mine Your Gold

Top Places in the U.S. Where You Can Mine Your Own Gold

For centuries, the allure of gold has driven people to venture into the wilderness, hoping to strike it rich. While the great gold rushes of the 19th century are long over, the opportunity to mine your own gold still exists today. Whether you’re a seasoned prospector or a curious beginner, there are several locations across the United States where you can try your hand at gold mining. In this article, we’ll explore some of the best places in the U.S. to mine your own gold.

1. California: The Heart of the Gold Rush

Key Locations:

- Jamestown: Located in the Sierra Nevada foothills, Jamestown is famous for its rich history in gold mining. Today, visitors can pan for gold at various locations, including Jamestown Gold Panning and the historic Gold Prospecting Adventures.

- Yuba River: The South Yuba River State Park offers recreational gold panning opportunities in a historic gold mining area.

Why Go: California is synonymous with the Gold Rush, and it’s the perfect place for those looking to experience a bit of that history firsthand. The state offers a variety of locations where you can pan for gold, from rivers to historic sites.

2. Alaska: The Last Frontier

Key Locations:

- Nome: This remote town on the Bering Sea is famous for its beach mining opportunities. Visitors can pan for gold right on the beach or join a guided mining tour.

- Fairbanks: The Fairbanks Gold Company offers visitors a chance to try gold panning and dredging.

Why Go: Alaska’s rugged landscape and rich gold history make it a top destination for serious gold hunters. The state offers some of the most rewarding gold panning experiences, with the potential for significant finds.

3. North Carolina: The First Gold Rush

Key Locations:

- Reed Gold Mine: Located in Midland, North Carolina, Reed Gold Mine was the site of the first documented gold find in the United States. Visitors can tour the historic mine and try their hand at panning for gold.

- Cotton Patch Gold Mine: A family-friendly location where you can pan for gold or screen for gems.

Why Go: North Carolina holds a special place in American gold history, and it’s an excellent destination for those looking to combine a historical experience with recreational gold panning.

4. Colorado: Rocky Mountain Gold

Key Locations:

- Cripple Creek & Victor Gold Mine: Once the site of Colorado’s largest gold strike, this area offers visitors the chance to tour historic mines and pan for gold.

- Fairplay: Known as the “Official Trout Fishing Capital of Colorado,” Fairplay also offers recreational gold panning opportunities.

Why Go: Colorado’s rich mining history and beautiful mountain scenery make it a top destination for gold prospectors. The state offers a variety of experiences, from panning to exploring historic mines.

5. Georgia: The Forgotten Gold Rush

Key Locations:

- Dahlonega: Home to the first major gold rush in the U.S., Dahlonega offers visitors a chance to pan for gold at the Crisson Gold Mine and Consolidated Gold Mine.

- Gold ‘n Gem Grubbin’: Located in Cleveland, Georgia, this site allows visitors to pan for gold and gems.

Why Go: Georgia’s gold rush history is less well-known than California’s, but it offers rich opportunities for those looking to mine their own gold. Dahlonega, in particular, is a must-visit for gold enthusiasts.

6. South Dakota: The Black Hills

Key Locations:

- Big Thunder Gold Mine: Located in Keystone, this historic mine offers guided tours and gold panning experiences.

- Wades Gold Mill: A unique experience where visitors can tour an operational gold mill and pan for gold.

Why Go: The Black Hills of South Dakota are steeped in gold mining history, and the area offers a variety of ways to experience the thrill of finding gold. The scenic beauty of the Black Hills is an added bonus.

7. Oregon: Gold in the Rivers

Key Locations:

- Rogue River: The Rogue River is known for its gold panning opportunities, particularly in the areas near Gold Hill and Grants Pass.

- Applegate River: Another great location for gold panning in Oregon, offering beautiful scenery and potential gold finds.

Why Go: Oregon’s rivers have been a source of gold for centuries, and the state continues to attract gold prospectors. The natural beauty of the region makes it a great destination for outdoor enthusiasts and gold seekers alike.

8. Montana: Gold in the Big Sky Country

Key Locations:

- Libby Creek: The Libby Creek Recreational Gold Panning Area offers a public gold panning site where visitors can try their luck.

- Bannack State Park: A historic ghost town where you can pan for gold and explore the remnants of Montana’s gold rush history.

Why Go: Montana’s vast wilderness and rich gold history provide an authentic gold mining experience. The state’s public gold panning areas make it accessible to beginners and seasoned prospectors alike.

Tips for Successful Gold Mining Adventures

- Research Local Regulations: Before you start panning, make sure you’re aware of the local regulations and obtain any necessary permits.

- Bring the Right Equipment: Basic gold panning kits are inexpensive and readily available. If you’re planning on mining for extended periods, consider investing in more advanced tools.

- Join a Guided Tour: Many of the locations mentioned offer guided gold panning tours, which can be a great way to learn the ropes and increase your chances of finding gold.

- Stay Safe: Always be aware of your surroundings, especially when working near rivers or in remote areas. Bring plenty of water, wear sunscreen, and be prepared for the elements.

Conclusion: A Golden Opportunity Awaits

Whether you’re looking to relive the thrill of the gold rush or simply enjoy a unique outdoor adventure, gold mining in the United States offers something for everyone. From California to Alaska, and from Georgia to Montana, the opportunities to mine your own gold are as vast as the country itself. So grab your pan, do your research, and head out to one of these top gold mining destinations—you never know what you might find!

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold in Play Sand

Striking Gold in Store-Bought Play Sand: A Surprising Trend

When you think of finding gold, images of panning in rivers or digging deep into the earth might come to mind. But what if you could discover gold in the most unexpected place—store-bought play sand? This surprising trend has caught the attention of many, sparking excitement and curiosity among treasure hunters and hobbyists alike. In this blog, we’ll explore how people are finding gold in play sand, why it’s happening, and what it means for gold enthusiasts.

The Unexpected Discovery: Gold in Play Sand

The idea of finding gold in play sand sounds like something out of a child’s imagination, but it’s very real. Over the past few years, reports have emerged of people discovering tiny flecks of gold in bags of play sand purchased from hardware stores and online retailers. While the amounts found are usually minuscule, the thrill of uncovering real gold in such an unlikely source has sparked a wave of interest.

How Does Gold End Up in Play Sand?

The presence of gold in play sand can be attributed to the natural origins of the sand itself. Play sand is often sourced from riverbeds, beaches, and quarries where tiny particles of gold can naturally occur. During the mining and processing of sand, small amounts of gold dust or flakes can inadvertently be mixed in with the sand.

However, it’s important to note that the amount of gold found in play sand is typically very small—usually just a few tiny specks. These tiny gold particles are often overlooked during the sand’s production process because their size and quantity are too insignificant to be considered commercially valuable.

Tools of the Trade: How People Are Finding Gold in Sand

Finding gold in play sand requires a bit of patience and the right tools. Here’s a step-by-step guide that some enthusiasts have used to extract gold from play sand:

- Gather Materials:

- A bag of play sand (the finer the sand, the better).

- A gold pan or a shallow container.

- A magnifying glass or jeweler’s loupe.

- A magnet (to help separate magnetic minerals like iron from the sand).

- Pan the Sand:

- Just like traditional gold panning, scoop a small amount of sand into your gold pan.

- Swirl the pan in water, allowing the lighter sand particles to wash away, while the heavier materials (including gold) settle at the bottom.

- Inspect for Gold:

- After panning, carefully examine the remaining material in the pan. Use a magnifying glass to look for tiny flecks of gold.

- Repeat:

- Depending on the size of the sandbag and your luck, you may need to repeat this process several times to find any gold.

Why Is This Trend Gaining Popularity?

The trend of finding gold in play sand has grown in popularity for several reasons:

- Low Cost, High Thrill: A bag of play sand costs only a few dollars, making it an affordable way to experience the thrill of gold prospecting without the need for expensive equipment or travel.

- Educational Value: For parents and educators, this trend offers a fun and educational activity for kids, teaching them about geology, minerals, and the history of gold prospecting.

- Hobbyist Appeal: For hobbyists and collectors, finding even the tiniest speck of gold is a rewarding experience. It adds an element of surprise to an otherwise ordinary product.

The Reality Check: How Much Gold Can You Actually Find?

While the idea of finding gold in play sand is exciting, it’s important to manage expectations. The amounts of gold found are usually very small—often just a few microscopic specks that may not even be visible to the naked eye. The gold content in play sand is nowhere near the level that would make it a profitable venture. Most people who engage in this activity do so for fun rather than financial gain.

Is It Worth the Effort?

For those who enjoy treasure hunting or gold panning as a hobby, searching for gold in play sand can be a fun and engaging activity. It’s an inexpensive way to experience the excitement of gold prospecting and can be a great way to introduce children to the wonders of geology. However, if you’re looking to strike it rich, traditional gold prospecting methods or investing in gold might be more effective.

Conclusion: A Modern-Day Treasure Hunt

The discovery of gold in store-bought play sand is a fascinating reminder that treasure can be found in the most unexpected places. While the amounts of gold found are typically small, the experience of uncovering real gold in an everyday product adds a touch of adventure to ordinary life. Whether you’re a seasoned gold enthusiast or just looking for a fun activity, this trend offers a unique way to connect with the age-old allure of gold hunting.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Fools Gold

Fool’s Gold: What It Is and How to Tell It Apart from Real Gold

Gold has always been a symbol of wealth and prosperity, but not everything that glitters is gold. The term “fool’s gold” refers to minerals that resemble real gold but have little to no value. Mistaking fool’s gold for the real thing has led many to disappointment, especially during the gold rushes when eager prospectors were misled by its deceptive appearance. In this article, we’ll explore what fool’s gold is, how it differs from real gold, and how to identify it.

What Is Fool’s Gold?

Fool’s gold is a common nickname for the mineral pyrite. The name “pyrite” comes from the Greek word “pyr,” meaning fire, because pyrite can create sparks when struck against metal or stone. Pyrite is an iron sulfide with a metallic luster and pale brass-yellow hue, which is why it’s often mistaken for gold.

Why Is It Called Fool’s Gold?

The term “fool’s gold” originated during the gold rush of the 19th century. Eager prospectors, in their quest for wealth, would often stumble upon pyrite and mistake it for gold. When they realized that their find was worthless, the term “fool’s gold” became synonymous with false hope or something that appears valuable but is not.

Key Differences Between Fool’s Gold and Real Gold

Despite their similar appearances, fool’s gold and real gold have distinct differences. Here’s how they compare:

| Characteristic | Fool’s Gold (Pyrite) | Real Gold |

|---|---|---|

| Color | Pale brass-yellow | Rich, bright yellow |

| Luster | Metallic, shiny | Metallic, but softer and warmer |

| Density | Less dense, feels lighter | Very dense, feels heavier |

| Hardness | Hard and brittle | Soft and malleable |

| Streak Test | Greenish-black streak | Yellow streak |

| Shape | Often forms cubic or crystalline shapes | Nuggets or irregular shapes |

| Reaction to Acid | No reaction | Dissolves in nitric acid |

How to Identify Fool’s Gold

If you ever come across a gold-like substance and want to determine whether it’s real gold or fool’s gold, there are several tests you can perform:

- Visual Inspection:

- Color and Luster: Real gold has a richer, deeper yellow color, while pyrite tends to have a paler, brass-like appearance. Gold’s luster is softer and warmer, while pyrite has a more metallic and shiny appearance.

- Shape: Pyrite often forms in cubic or crystalline shapes, whereas gold is typically found in nuggets or irregular shapes.

- Hardness Test:

- Gold is soft and can be scratched with a pocket knife. Pyrite, on the other hand, is much harder and cannot be scratched easily. In fact, pyrite can scratch glass, whereas gold cannot.

- Streak Test:

- Rub the mineral across a piece of unglazed ceramic tile. Pyrite will leave a greenish-black streak, while real gold will leave a yellow streak.

- Density Test:

- Gold is significantly denser than pyrite. If you have access to a scale and some water, you can perform a simple density test by calculating the weight of the mineral in air versus its weight in water. Real gold will feel heavier than pyrite of the same size.

- Acid Test:

- Nitric acid is used to test the authenticity of gold. Real gold will not react to nitric acid, whereas pyrite will produce a fizzing reaction.

The Role of Fool’s Gold in History and Culture

Fool’s gold, while not valuable as a precious metal, has played an interesting role in history. Pyrite was used in ancient times to create sparks for starting fires and even in the production of sulfuric acid. Its misleading appearance has made it a symbol of false promises, leading to its frequent use in literature and idioms to describe things that appear valuable but are not.

Can Fool’s Gold Be Valuable?

While fool’s gold isn’t worth much in terms of precious metal value, it does have some uses in industry. Pyrite is sometimes used in the production of sulfuric acid and as a source of iron. Additionally, well-formed pyrite crystals can be collected and sold to mineral enthusiasts.

Conclusion: Don’t Be Fooled by Fool’s Gold

Understanding the differences between fool’s gold and real gold is essential for anyone interested in gold buying or prospecting. While fool’s gold might look convincing at first glance, a closer inspection reveals its true nature. By learning how to identify fool’s gold, you can avoid the disappointment of mistaking it for the real thing and make more informed decisions in your gold-buying endeavors.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

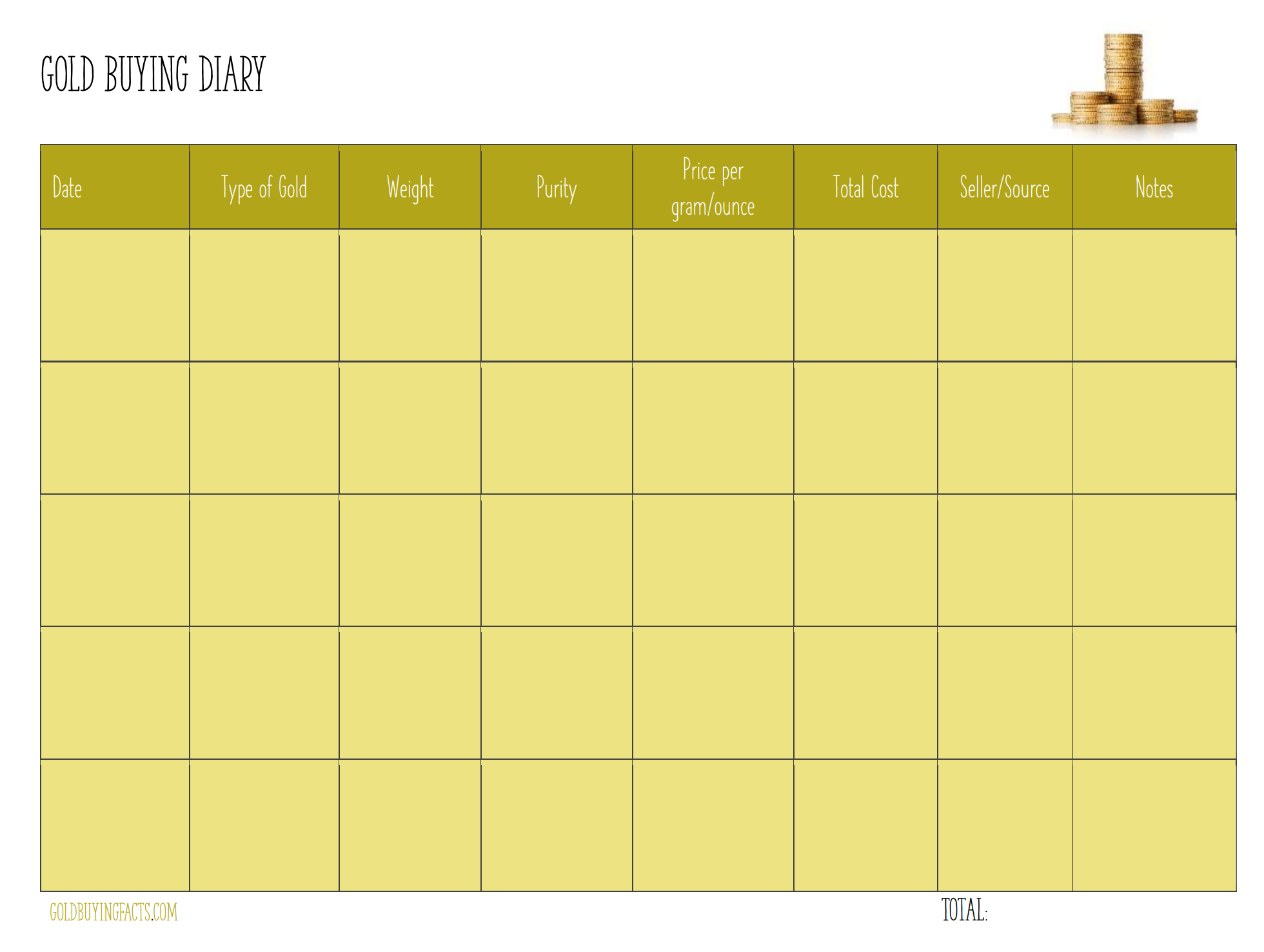

My Gold Buying Diary

My Gold Buying Diary

Creating a gold buying diary is an excellent way to keep track of your investments in gold, monitor your purchasing habits, and evaluate the performance of your assets over time. Below is a template and guide for creating a gold buying diary, including what information to include and how to organize it effectively.

Introduction

Start your diary with an introduction outlining your goals for tracking your gold purchases. You might include why you’re investing in gold, what you hope to achieve, and any specific strategies or targets you have in mind.

Gold Purchase Log

The main section of your diary will be the Gold Purchase Log. This section will help you keep track of every gold purchase you make. You can create this log in a notebook, or spreadsheet, or use a digital app. Below is an example of how to structure each entry:

| Date | Type of Gold | Weight | Purity | Price per Gram/Ounce | Total Cost | Seller/Source | Notes |

|---|---|---|---|---|---|---|---|

| 08/10/2024 | Gold Bullion Bar | 1 oz | 24K (99.9%) | $1,950/oz | $1,950 | ABC Gold Dealers | First purchase of the month, bought for long-term investment. |

| 08/15/2024 | Gold Coin | 1/2 oz | 22K (91.7%) | $1,900/oz | $950 | XYZ Coin Shop | Purchased for collection, limited edition coin. |

Explanation of Columns:

- Date: The date when you made the purchase.

- Type of Gold: Specify what you purchased, such as a gold bar, coin, jewelry, or shares in a gold ETF.

- Weight: The weight of the gold item, typically in grams or ounces.

- Purity: The karat rating or purity percentage of the gold.

- Price per Gram/Ounce: The price you paid per unit of weight.

- Total Cost: The total amount you spent on the purchase.

- Seller/Source: Where you bought the gold, such as a specific dealer, shop, or online marketplace.

- Notes: Any additional information, such as the reason for the purchase, special features of the item, or market conditions at the time.

Monthly Summary

At the end of each month, include a summary that helps you review your purchasing habits and the performance of your gold investments. Consider including the following:

- Total Gold Purchased: Sum the total weight of gold you bought that month.

- Average Price per Gram/Ounce: Calculate the average price you paid across all purchases.

- Total Expenditure: Sum the total amount you spent on gold that month.

- Market Trends: Note any significant changes in the gold market, such as price fluctuations, economic events, or news that might have influenced your buying decisions.

- Reflections: Reflect on your purchases—did you stick to your budget? Did you find any particularly good deals? What would you do differently next month?

Yearly Overview

At the end of the year, compile your data to create an annual overview. This can help you see long-term trends and assess your gold investment strategy. Include:

- Total Gold Purchased for the Year

- Total Expenditure

- Average Price per Gram/Ounce for the Year

- Overall Market Trends

- Year-End Reflection: Evaluate how your gold investments performed, consider whether you met your goals, and plan for the coming year.

Gold Price Tracking Chart

Include a chart or graph that tracks the gold prices over time. You can update this monthly or quarterly to visualize how market prices have changed. This can be done manually or using a spreadsheet program.

Additional Sections

- Investment Strategy: Detail your gold investment strategy, including target allocation, buying triggers, and any rules you follow when making purchases.

- Resources: List trusted sources of information on gold markets, such as websites, newsletters, or financial advisors.

- Wish List: Keep a list of gold items you’re interested in purchasing in the future, along with notes on why they appeal to you.

Get your free Gold buying diary .pdf > > Gold buying diary < <

Conclusion

Wrap up your diary with a final section where you reflect on your gold-buying journey. This could be a space to write annual summaries, adjust your strategy, or set new goals.

By maintaining this diary, you’ll be able to track your gold investments methodically, make informed decisions, and stay on top of your financial goals. Feel free to customize the template to suit your specific needs and preferences!

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold Rush Stories

Gold Rush Stories: Tales of Adventure, Fortune, and Hardship

The allure of gold has driven people to embark on incredible journeys and take on tremendous risks in search of fortune. Gold rushes have been a significant part of history, inspiring waves of migration, fueling economies, and even leading to the founding of entire cities. In this article, we’ll explore some of the most famous gold rush stories, highlighting the excitement, challenges, and unforgettable moments that defined these periods of gold fever.

1. The California Gold Rush (1848-1855)

“There’s gold in them thar hills!”

The California Gold Rush is perhaps the most famous gold rush in history. It all began in January 1848 when James W. Marshall discovered gold at Sutter’s Mill in Coloma, California. Word quickly spread, and by 1849, hundreds of thousands of people from all over the world had descended upon California, hoping to strike it rich. These fortune-seekers, known as “Forty-Niners,” faced grueling journeys, dangerous conditions, and fierce competition.

The influx of people led to the rapid development of towns and cities, including San Francisco, which transformed from a sleepy village into a booming metropolis almost overnight. While some struck it rich, many others found themselves facing harsh realities, with most of the wealth ending up in the hands of merchants, landowners, and service providers. The California Gold Rush not only changed the face of the American West but also left an indelible mark on American culture and history.

2. The Klondike Gold Rush (1896-1899)

“To the Klondike or bust!”

The Klondike Gold Rush, also known as the Yukon Gold Rush, took place in the late 19th century and was one of the last great gold rushes. It was triggered in 1896 when gold was discovered in Bonanza Creek, a tributary of the Klondike River in Canada’s Yukon Territory. News of the discovery reached the rest of the world in 1897, setting off a frenzy as tens of thousands of prospectors, known as “stampeders,” made the treacherous journey to the remote and freezing Klondike region.

The journey to the Klondike was perilous, with many prospectors having to cross the grueling Chilkoot Pass or White Pass, enduring freezing temperatures, treacherous terrain, and the constant threat of starvation and disease. Only a small percentage of those who set out actually reached the goldfields, and even fewer struck it rich. However, the Klondike Gold Rush left a lasting legacy, immortalized in literature and film, and helped shape the development of the Yukon and Alaska.

3. The Australian Gold Rushes (1851-1893)

“Australia’s rivers of gold.”

Australia experienced several significant gold rushes throughout the 19th century, beginning with the discovery of gold in New South Wales in 1851. This discovery sparked the first major Australian gold rush, drawing thousands of people from across the globe to the land down under. The rush spread quickly to other parts of Australia, including Victoria, where the rich goldfields of Ballarat and Bendigo became legendary.

The Australian gold rush had a profound impact on the country’s development, leading to rapid population growth, the expansion of infrastructure, and the establishment of new towns and cities. The influx of people from all over the world also contributed to Australia’s multicultural society. The legacy of the Australian gold rush is still evident today, with many towns and regions celebrating their gold rush heritage through festivals, museums, and preserved historical sites.

4. The Black Hills Gold Rush (1874-1877)

“Gold in the sacred hills.”

The Black Hills Gold Rush began in the mid-1870s in what is now South Dakota. This gold rush was unique in that it took place in the Black Hills, an area considered sacred by the Lakota Sioux people. The discovery of gold in the Black Hills was made by an expedition led by General George Armstrong Custer in 1874, sparking a rush of miners to the area.

The rush led to significant conflict between the U.S. government and the Sioux, as miners encroached on lands promised to the Sioux by treaty. This tension eventually culminated in the Great Sioux War of 1876-77, including the famous Battle of Little Bighorn. Despite the conflict, the Black Hills Gold Rush brought a surge of settlers to the region, leading to the establishment of towns like Deadwood and the growth of the regional economy.

5. The Witwatersrand Gold Rush (1886)

“Gold at the heart of South Africa.”

The Witwatersrand Gold Rush was one of the most significant gold discoveries in history and played a crucial role in shaping modern South Africa. In 1886, a massive gold deposit was discovered in the Witwatersrand region, located near present-day Johannesburg. This discovery set off a gold rush that attracted prospectors from around the world and led to the rapid growth of Johannesburg, which became the largest city in South Africa.

The Witwatersrand Gold Rush transformed South Africa’s economy, making it one of the world’s largest gold producers. However, it also had profound social and political consequences, contributing to the complex and often troubled history of the region. The wealth generated by the gold rush laid the foundations for South Africa’s mining industry, which remains a key part of the country’s economy to this day.

Conclusion: The Legacy of Gold Rushes

Gold rushes have left a lasting legacy on the regions where they occurred, shaping economies, societies, and even national identities. While the promise of instant wealth attracted countless hopefuls, the reality of life during a gold rush was often harsh and unforgiving. Despite this, the stories of these gold rushes continue to captivate our imagination, offering a glimpse into a time when the pursuit of gold could change the course of history.

Whether driven by the dream of striking it rich or the thrill of adventure, those who participated in these gold rushes played a role in shaping the world as we know it today. Their stories of perseverance, ambition, and sometimes tragedy remind us of the powerful allure of gold and the lengths people will go to attain it.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Understanding Gold Karats

Understanding Gold Karats: A Comprehensive Guide

Gold has been cherished for centuries as a symbol of wealth, beauty, and prestige. However, not all gold is created equal. The purity of gold is often measured in karats, which indicate the proportion of gold in a piece of jewelry or other items. Understanding the different karats can help you make informed decisions when buying gold, whether for investment, fashion, or special occasions. In this article, we’ll explore what gold karats mean, how they differ, and what each karat is best suited for.

What Are Gold Karats?

The term “karat” (often abbreviated as “K” or “Kt”) refers to the purity of gold within a metal alloy. Pure gold is 24 karats, meaning it is 100% gold without any other metals mixed in. However, because pure gold is soft and malleable, it is often alloyed with other metals like copper, silver, or nickel to increase its strength and durability.

The karat number indicates how many parts out of 24 are pure gold. For example, 18K gold is 18 parts gold and 6 parts other metals, making it 75% pure gold. The higher the karat number, the higher the percentage of gold in the alloy.

The Different Karats in Gold

Here’s a breakdown of the most common gold karats, including their characteristics and typical uses:

| Karat | Gold Purity (%) | Gold Content | Color | Common Uses |

|---|---|---|---|---|

| 24K | 99.9% | Pure gold | Bright yellow | Investment-grade bars, coins, some high-end jewelry |

| 22K | 91.7% | 22 parts gold, 2 parts other metals | Slightly duller yellow | High-quality jewelry, coins |

| 18K | 75.0% | 18 parts gold, 6 parts other metals | Rich yellow, sometimes rosy | Fine jewelry, luxury watches |

| 14K | 58.3% | 14 parts gold, 10 parts other metals | Warm yellow, with variations | Everyday jewelry, engagement rings |

| 10K | 41.7% | 10 parts gold, 14 parts other metals | Pale yellow, sometimes white | Affordable jewelry, budget pieces |

| 9K | 37.5% | 9 parts gold, 15 parts other metals | Pale yellow, sometimes more metallic | Costume jewelry, lower-end pieces |

24 Karat Gold (24K)

24K gold is the purest form of gold you can buy, containing 99.9% gold. It is known for its bright, vibrant yellow color and is highly sought after for investment purposes. However, because it is so soft, it is rarely used for everyday jewelry. Instead, 24K gold is often used for gold bars, coins, and sometimes for high-end jewelry pieces where durability is not a primary concern.

22 Karat Gold (22K)

22K gold contains 91.7% gold, with the remaining 8.3% composed of other metals like silver or copper. This karat is commonly used in high-quality jewelry and coins. 22K gold maintains a rich yellow hue, but it is slightly more durable than 24K gold, making it more suitable for jewelry that is worn regularly, especially in cultures where higher karat jewelry is preferred.

18 Karat Gold (18K)

18K gold is made up of 75% gold and 25% other metals. It strikes a balance between purity and durability, making it one of the most popular choices for fine jewelry. The color of 18K gold can range from a rich yellow to a more rosy hue, depending on the metals used in the alloy. It is commonly used in engagement rings, luxury watches, and other high-end jewelry.

14 Karat Gold (14K)

14K gold contains 58.3% gold, with the remaining 41.7% made up of other metals. This lower gold content makes it more affordable and more durable, which is why it is often used for everyday jewelry like necklaces, bracelets, and rings. 14K gold can come in various colors, including yellow, white, and rose, depending on the alloy mixture.

10 Karat Gold (10K)

10K gold is the lowest karat gold that can still be legally labeled as gold in many countries, containing 41.7% gold. It is very durable and resistant to scratching, making it a practical choice for jewelry that is subject to daily wear. However, because of its lower gold content, 10K gold has a paler color and is less valuable than higher karats.

9 Karat Gold (9K)

9K gold is the least pure form of gold commonly used in jewelry, with only 37.5% gold content. It is often used for costume jewelry and lower-end pieces due to its affordability and durability. While it is still considered gold, its lower purity means it has a more metallic appearance and may not have the same luster as higher-karat gold.

Choosing the Right Karat

When choosing gold jewelry or making an investment, the karat you select will depend on your priorities—whether it’s purity, durability, color, or price. Higher karat golds, like 24K and 22K, are ideal for those who value purity and are willing to invest in more delicate pieces. Mid-range karats like 18K and 14K offer a good balance of purity and durability, making them popular for everyday wear. Lower karat golds like 10K and 9K are the most durable and affordable but offer less gold content and a different aesthetic.

Conclusion: Understanding Gold Karats

Understanding the different karats in gold is essential for making informed decisions whether you’re buying jewelry, investing in gold, or simply appreciating the beauty of this precious metal. Each karat has its own unique characteristics and is best suited for different uses, so knowing the differences can help you find the perfect piece to match your needs and style.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

The Allure of Rose Gold

The Allure of Rose Gold: A Unique Blend of Tradition and Modernity

In the world of fine jewelry, few metals have captivated hearts quite like rose gold. With its warm, pinkish hue, this distinctive alloy stands out as a symbol of romance, elegance, and contemporary style. But what exactly is rose gold, and what makes it so special? In this article, we’ll explore the origins, composition, and popularity of rose gold, and why it continues to be a favorite in both fashion and investment.

What is Rose Gold?

Rose gold is an alloy, meaning it is a combination of pure gold with other metals. Its characteristic pinkish color is achieved by blending gold with copper and, in some cases, a small amount of silver. The specific ratio of these metals can vary, but the most common blend is 75% gold, 22.5% copper, and 2.5% silver, which creates 18-karat rose gold.

The copper content is what gives rose gold its unique color. The more copper in the alloy, the more pronounced the pink hue becomes. This combination not only influences the color but also the durability of the metal. Copper adds strength to the otherwise soft and malleable gold, making rose gold more resistant to scratches and everyday wear.

The History of Rose Gold

The origins of rose gold date back to early 19th-century Russia, where it was first popularized and became known as “Russian gold.” The metal’s warm tones appealed to the tastes of the Russian aristocracy, and it was frequently used in the creation of luxurious jewelry pieces.

Rose gold’s popularity spread across Europe and America, particularly during the Victorian era, when it became synonymous with romantic and sentimental jewelry designs. The metal experienced a resurgence in the 1920s during the Art Deco period, when its unique color complemented the bold, geometric designs of the time.

In recent years, rose gold has seen a major comeback, thanks to its versatility and modern appeal. It is now widely used not only in jewelry but also in fashion, technology, and home décor, solidifying its status as a timeless and trendy choice.

Why is Rose Gold So Popular?

Several factors contribute to the enduring popularity of rose gold:

- Romantic Appeal: The soft, warm tones of rose gold are often associated with love and romance, making it a popular choice for engagement rings, wedding bands, and other sentimental jewelry.

- Versatility: Rose gold’s neutral yet distinctive color pairs well with a variety of skin tones and can be mixed and matched with other metals like white gold, yellow gold, and platinum. This versatility makes it a favorite for both classic and contemporary designs.

- Durability: The copper content in rose gold makes it more durable than yellow or white gold, which means it’s less prone to scratching and bending. This makes rose gold an excellent choice for everyday wear.

- Modern Aesthetic: Rose gold has become synonymous with modern luxury and innovation. It’s a popular choice in high-end fashion accessories, smartphones, and even interior design, reflecting a contemporary yet elegant style.

Investing in Rose Gold

When it comes to investment, rose gold carries many of the same considerations as other gold alloys. The value of rose gold jewelry or items is largely influenced by the current market price of gold, the purity of the alloy, and the craftsmanship involved in creating the piece.

However, because rose gold is an alloy, its resale value may be slightly lower compared to pure gold items. That said, its unique color and popularity can sometimes increase demand, particularly for well-crafted, designer pieces.

For investors looking to diversify their portfolio with precious metals, it’s important to note that while rose gold is stunning, it’s typically not a primary choice for bullion or coins. Instead, it’s more commonly valued for its beauty and fashion appeal.

Caring for Rose Gold

Like all fine jewelry, rose gold requires proper care to maintain its luster and beauty. Here are some tips to keep your rose gold pieces looking their best:

- Regular Cleaning: Clean your rose gold jewelry regularly with a soft cloth and warm, soapy water. Avoid harsh chemicals that can damage the metal or affect its color.

- Safe Storage: Store rose gold pieces separately from other jewelry to prevent scratches. Using a soft pouch or lined jewelry box is ideal.

- Professional Maintenance: For items like engagement rings or heirloom pieces, consider having them professionally cleaned and inspected periodically to ensure the metal and any gemstones remain secure and pristine.

Conclusion: The Timeless Charm of Rose Gold

Rose gold is more than just a trend; it’s a timeless choice that blends tradition with modernity. Whether you’re looking for a unique piece of jewelry, a romantic gift, or an elegant accessory, rose gold offers a warmth and beauty that stands out in any setting. Its versatility, durability, and romantic appeal make it a beloved metal that will continue to shine in the world of fashion and beyond.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Edible Gold in the Food Industry

The Golden Touch: Exploring the Use of Edible Gold in the Food Industry

Gold has long been synonymous with wealth, luxury, and opulence. From ancient times to the modern era, this precious metal has been used to signify status and prosperity. In recent years, gold has made its way into the culinary world, not as a utensil or decoration, but as a part of the food itself. Edible gold has become a popular trend in high-end dining, adding a touch of extravagance to dishes and drinks. In this article, we’ll explore the fascinating world of edible gold, its uses in the food industry, and whether it’s worth the price.

What is Edible Gold?

Edible gold is real gold that has been processed into a form safe for consumption. It is typically made from pure 24-karat gold or a mixture of gold and other metals, such as silver, which help to create the desired thinness and flexibility. The gold is usually crafted into fine sheets, flakes, or powder that can be used to adorn a variety of foods and beverages.

To be classified as edible, the gold must be of high purity (typically 22-24 karats) and meet specific safety standards set by food regulatory authorities. This means that it is non-toxic, tasteless, and does not react with other foods, making it an ideal decorative element in culinary creations.

A Brief History of Edible Gold

The use of gold in food is not a modern invention. The tradition dates back centuries, with ancient civilizations like the Egyptians, Romans, and Chinese incorporating gold into their diets. In medieval Europe, gold was often used in elaborate feasts to display wealth and power. Renaissance royalty would consume dishes laced with gold to demonstrate their affluence and believed that eating gold had health benefits, such as prolonging life and improving vitality.

The Modern Trend: Gold on Your Plate

In today’s food industry, edible gold is often associated with luxury dining and special occasions. Chefs and mixologists use it to add a sense of grandeur and exclusivity to their creations. Some of the most common uses of edible gold include:

- Gilded Desserts: Cakes, chocolates, and pastries are frequently adorned with gold leaf to enhance their visual appeal. Gold leaf is often used to cover entire cakes, cupcakes, or even individual chocolates, turning them into glittering masterpieces.

- Gold-Infused Drinks: High-end bars and restaurants have embraced the trend of adding gold flakes to cocktails, champagne, and even coffee. A sprinkle of gold can elevate a drink from ordinary to extraordinary, making it a favorite for celebratory toasts and special events.

- Opulent Entrees: Some chefs take luxury to the next level by incorporating edible gold into main courses. For example, steaks, sushi, and even burgers have been embellished with gold leaf, making them the centerpiece of a lavish dining experience.

- Gourmet Garnishes: Gold is also used as a garnish for a variety of gourmet dishes, from appetizers to desserts. Whether sprinkled on top of a dish or used to highlight certain elements, gold adds a luxurious finishing touch.

Is Edible Gold Safe?

Edible gold is considered safe for consumption in small quantities. Since gold is a noble metal, it is resistant to corrosion and does not react with other substances, making it non-toxic and safe to eat. However, it is important to ensure that the gold used is specifically labeled as “edible” and meets the necessary purity and safety standards.

That being said, edible gold does not provide any nutritional value or health benefits. It is purely an aesthetic addition to food, meant to enhance the visual appeal and create a sense of luxury.

The Cost of Edible Gold

As you might expect, edible gold comes with a hefty price tag. The cost varies depending on the form (leaf, flakes, or powder) and the quantity purchased. Gold leaf is generally more expensive than flakes or powder due to the labor-intensive process required to create the ultra-thin sheets.

For those willing to indulge in this extravagance, the price is often justified by the unique experience and the sense of luxury it brings to the dining table. However, for most people, edible gold remains a rare and special treat reserved for the most opulent of occasions.

Conclusion: A Taste of Luxury

Edible gold is the ultimate symbol of luxury in the culinary world. While it may not offer any nutritional benefits, its ability to transform a dish or drink into a work of art is undeniable. Whether you’re celebrating a milestone event or simply want to indulge in something extraordinary, edible gold offers a taste of the high life—literally.

At the end of the day, the use of gold in food is less about practicality and more about creating a memorable and lavish experience. For those who can afford it, edible gold turns an ordinary meal into a glittering feast fit for royalty.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

The Most Daring Gold Heists in History

The Most Daring Gold Heists in History

Gold, with its glittering allure and timeless value, has been a symbol of wealth and power for millennia. It’s no surprise, then, that it has been the target of some of the most audacious heists throughout history. These gold thefts, often involving meticulous planning and nerve-wracking execution, have captivated the public’s imagination. Below, we delve into some of the most famous gold heists that have left their mark on history.

1. The Great Gold Robbery of 1855

One of the earliest and most infamous gold heists occurred in Victorian England. On the night of May 15, 1855, a group of criminals managed to steal £12,000 worth of gold (equivalent to about £1.4 million today) from a train traveling from London to Paris. The robbery was meticulously planned over several months, with the gang replacing the legitimate gold-filled boxes with lead shots. The mastermind behind the heist, Edward Agar, was eventually caught, but the gold was never fully recovered.

2. The Brink’s-Mat Heist (1983)

Dubbed the “Crime of the Century,” the Brink’s-Mat robbery is one of the most well-known heists in British history. On November 26, 1983, a group of robbers broke into the Brink’s-Mat warehouse at Heathrow Airport, expecting to find £3 million in cash. Instead, they stumbled upon £26 million worth of gold bullion, diamonds, and cash. The gang, led by Brian Robinson and Mickey McAvoy, made off with the loot, but the heist eventually led to a series of violent reprisals and one of the largest investigations in British history. Only a fraction of the gold was ever recovered, and much of it is believed to have been smelted and sold off.

3. The Isabella Stewart Gardner Museum Heist (1990)

While not exclusively a gold heist, the theft from the Isabella Stewart Gardner Museum in Boston on March 18, 1990, included a priceless gold finial. Two men disguised as police officers gained entry to the museum, overpowering the guards and making off with 13 pieces of art, including a gilded eagle finial from a Napoleonic flag. The stolen items, valued at over $500 million, have never been recovered, making this one of the most significant unsolved art heists in history.

4. The Schiphol Airport Heist (2005)

On February 25, 2005, one of the most daring gold heists occurred at Amsterdam’s Schiphol Airport. Disguised as KLM airline employees, the robbers intercepted a truck transporting gold and diamonds from a Swissair flight. The heist was carried out with military precision, and the thieves made off with gold bars worth an estimated €75 million. Despite a few arrests, the bulk of the gold remains missing.

5. The Canadian Royal Mint Heist (2008)

In one of the more peculiar gold heists, a Royal Canadian Mint employee, Leston Lawrence, managed to smuggle $190,000 worth of gold out of the high-security facility in Ottawa between 2008 and 2015. Lawrence used a sophisticated technique to hide gold nuggets inside his body, bypassing metal detectors. He was eventually caught when he tried to sell the gold to a local pawn shop, leading to a high-profile trial and conviction.

6. The Hatton Garden Heist (2015)

While primarily known for its theft of jewels, the Hatton Garden Heist also involved the theft of a significant amount of gold. Over the Easter weekend in 2015, a group of elderly criminals, later dubbed the “Bad Grandpas,” broke into a vault in London’s Hatton Garden jewelry district. Using sophisticated drilling equipment, they accessed the vault, making off with over £14 million worth of gold, cash, and jewels. The heist was remarkable not only for the age of the perpetrators but also for their audacity and the thoroughness of their planning.

Conclusion

Gold heists, with their mix of danger, cunning, and high stakes, continue to fascinate people worldwide. These stories serve as a reminder of both the enduring value of gold and the lengths to which some will go to possess it. While many of the culprits behind these famous heists were eventually caught, the allure of gold remains as strong as ever, inspiring both legal and illegal pursuits.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Exploring Career Opportunities in the Gold Industry

Exploring Career Opportunities in the Gold Industry

The gold industry has long been a cornerstone of the global economy, offering a wide range of career opportunities for those interested in this precious metal. From mining and refining to trading and investing, the gold sector is a dynamic field with numerous pathways for professionals at all levels. Whether you’re passionate about geology, finance, or craftsmanship, there’s likely a career in gold that aligns with your skills and interests.

1. Gold Mining and Exploration

a. Geologists and Exploration Scientists:

One of the most fundamental roles in the gold industry is that of geologists and exploration scientists. These professionals are responsible for locating new gold deposits, conducting fieldwork, and analyzing geological data. They use cutting-edge technology and techniques to identify promising mining sites, making their work crucial to the industry’s success.

b. Mining Engineers:

Mining engineers design and oversee the construction of mines, ensuring they are safe, efficient, and environmentally sustainable. They work closely with geologists to extract gold ore while minimizing the impact on the surrounding environment. This role requires a strong background in engineering and environmental science.

c. Drillers and Blasters:

These skilled workers are involved in the physical process of extracting gold from the earth. Drillers operate machinery to bore holes in the ground, while blasters use controlled explosions to break apart rock formations, making it easier to access gold deposits.

2. Gold Refining and Processing

a. Metallurgists:

Metallurgists play a key role in the gold refining process. They study the properties of metals and develop methods to extract and purify gold from its ore. This involves chemical processes, smelting, and refining to produce pure gold ready for use in various applications.

b. Refinery Technicians:

Refinery technicians work in gold refineries where they operate equipment to process raw gold into refined bars or other products. Their work is highly specialized, requiring knowledge of chemical processes and adherence to strict safety protocols.

c. Environmental and Safety Officers:

In the refining and processing stages, environmental and safety officers ensure that operations comply with environmental regulations and safety standards. They work to minimize the ecological impact of gold production and protect workers from potential hazards.

3. Gold Trading and Investment

a. Commodity Traders:

Gold is one of the most traded commodities in the world. Commodity traders specialize in buying and selling gold on global markets, analyzing trends, and making strategic decisions to maximize profits. This role requires a strong understanding of financial markets and economic indicators.

b. Financial Analysts:

Financial analysts in the gold industry provide insights and recommendations for investors interested in gold. They analyze market trends, evaluate risks, and forecast future prices, helping investors make informed decisions. This role is ideal for those with a background in finance or economics.

c. Investment Advisors:

Investment advisors who specialize in gold offer personalized advice to clients looking to diversify their portfolios with precious metals. They guide clients through the process of buying gold bullion, coins, or stocks in gold mining companies, tailoring their advice to each client’s financial goals.

4. Gold Jewelry and Craftsmanship

a. Jewelers and Goldsmiths:

Jewelers and goldsmiths create beautiful and intricate pieces of jewelry from gold. This profession combines artistic talent with technical skills, as craftsmen must work with gold’s unique properties to design and produce high-quality jewelry. This career path is perfect for those with a passion for design and attention to detail.

b. Jewelry Appraisers:

Jewelry appraisers assess the value of gold jewelry, taking into account factors like purity, craftsmanship, and market demand. This role requires a deep understanding of the gold market and the ability to accurately evaluate the worth of individual pieces.

c. Retail Sales Professionals:

Retail professionals in the gold jewelry industry sell gold products to consumers, providing advice and information to help them make informed purchasing decisions. This role requires excellent customer service skills and a strong knowledge of gold products.

5. Environmental and Sustainability Roles

a. Environmental Scientists:

As the gold industry continues to evolve, there is a growing focus on sustainability. Environmental scientists work to ensure that gold mining and processing practices are environmentally responsible. They develop strategies to reduce the ecological footprint of gold production and work to rehabilitate mining sites.

b. Sustainability Consultants:

Sustainability consultants help gold companies implement green practices and achieve certification for environmentally friendly operations. They work to improve the industry’s overall sustainability, focusing on everything from reducing energy consumption to ethical sourcing of gold.

6. Legal and Compliance Roles

a. Legal Advisors:

Legal advisors in the gold industry ensure that companies comply with national and international laws, including environmental regulations, labor laws, and trade agreements. They provide legal guidance on contracts, mergers, and acquisitions, making their role essential for the smooth operation of gold-related businesses.

b. Compliance Officers:

Compliance officers work to ensure that gold companies adhere to industry regulations, ethical standards, and internal policies. They monitor operations, conduct audits, and implement corrective actions to prevent violations, protecting the company’s reputation and minimizing legal risks.

7. Educational and Research Opportunities

a. Academics and Researchers:

Academics and researchers in the gold industry contribute to advancing knowledge in areas such as mineralogy, metallurgy, and economics. They conduct research, publish papers, and teach the next generation of gold industry professionals, making this a fulfilling career for those passionate about education and discovery.

b. Industry Trainers:

Industry trainers provide specialized education and training programs for professionals in the gold sector. They develop curricula, conduct workshops, and offer hands-on training in areas such as mining technology, safety practices, and financial analysis.

Conclusion: A Wealth of Opportunities in the Gold Industry

The gold industry offers diverse career opportunities, from hands-on roles in mining and refining to strategic positions in trading and investment. Whether you’re interested in the scientific, financial, or artistic aspects of gold, there’s a pathway that can lead to a rewarding and fulfilling career.

As the global demand for gold continues to grow, so does the need for skilled professionals across all areas of the industry. If you’re considering a career in gold, now is a great time to explore the possibilities and find your niche in this enduring and dynamic field.

For more information on the gold industry and related topics, explore additional resources and articles on GoldBuyingFacts.com.

15 Fascinating Facts About Gold

15 Fascinating Facts About Gold You Probably Didn’t Know

Gold has captured human fascination for millennia. From ancient civilizations to modern economies, this precious metal has played a crucial role in shaping history and culture. Whether you’re an investor, collector, or simply curious, here are 15 interesting facts about gold that highlight its unique properties and enduring appeal.

1. Gold Is Almost Indestructible

Gold is one of the most durable substances on Earth. It doesn’t tarnish, rust, or corrode, making it incredibly resistant to the elements. The gold we have today is the same gold that existed millions of years ago. It’s estimated that all the gold ever mined still exists in some form.

2. Gold Is Incredibly Malleable

One of gold’s most remarkable properties is its malleability. Just one ounce of gold can be hammered into a sheet that covers 300 square feet. It can also be drawn into a thin wire stretching for miles without breaking. This malleability makes gold perfect for a variety of uses, from intricate jewelry designs to electronic components.

3. Gold Is Edible

Believe it or not, gold is non-toxic and can be safely ingested in small quantities. Gold leaf is often used to decorate gourmet dishes, desserts, and even beverages. It’s considered a symbol of luxury and indulgence, especially in high-end culinary circles.

4. Gold Is Found in Space

Gold isn’t just found on Earth; it’s also present in space. Scientists have discovered that gold is formed in supernova explosions and colliding neutron stars. In fact, some of the gold on Earth likely originated from meteorites that bombarded the planet billions of years ago.

5. The World’s Largest Gold Nugget

The largest gold nugget ever found is known as the “Welcome Stranger.” It was discovered in Australia in 1869 and weighed an astonishing 72 kilograms (158.7 pounds). This massive nugget was so large that it had to be broken into smaller pieces before it could be weighed.

6. Gold Is Used in Medicine

Gold has unique properties that make it valuable in the field of medicine. It’s used in treatments for conditions such as rheumatoid arthritis and certain types of cancer. Gold nanoparticles are also being researched for their potential in targeted drug delivery and diagnostic imaging.

7. Olympic Gold Medals Aren’t Pure Gold

While Olympic gold medals are among the most coveted prizes in sports, they aren’t made entirely of gold. Since 1912, Olympic gold medals have been primarily composed of silver and are only coated with about 6 grams of pure gold.

8. There’s a Lot of Gold in the Oceans

It’s estimated that there are about 20 million tons of gold dissolved in the world’s oceans. However, the concentration is so low—about 13 billionths of a gram per liter—that it’s not currently feasible to extract it commercially.

9. Gold Is a Great Conductor of Electricity

Gold is an excellent conductor of electricity, which is why it’s widely used in electronics. Despite being more expensive than other conductive metals like copper and silver, gold’s resistance to tarnishing makes it ideal for high-reliability applications, such as in satellites and computers.

10. Gold Coins Have Been Used for Over 2,500 Years

The first known gold coins were minted in Lydia, an ancient kingdom in what is now Turkey, around 600 BCE. These early coins were a blend of gold and silver, known as electrum, and were used for trade and commerce.

11. Gold Is Measured in Karats

Gold purity is measured in karats, with 24-karat gold being pure gold. Lower karat numbers, such as 18K or 14K, indicate that the gold has been alloyed with other metals for added strength and durability, which is common in jewelry.

12. The Value of Gold Is Timeless

Gold has been valued by every major civilization in history, from the ancient Egyptians to the present day. Its status as a symbol of wealth and power has never diminished, making it a timeless asset and a reliable store of value.

13. Gold’s Melting Point Is Astonishingly High

Gold has a melting point of 1,064 degrees Celsius (1,947 degrees Fahrenheit). This high melting point, combined with its durability and resistance to corrosion, makes gold suitable for use in high-temperature applications, such as in aerospace engineering.

14. Gold Is a Global Currency

Even though we no longer use gold coins in everyday transactions, gold is still recognized as a form of currency. Central banks around the world hold gold reserves as a hedge against economic instability and as a means of settling international debts.

15. The Total Amount of Gold Ever Mined

It’s estimated that about 197,576 metric tons of gold have been mined throughout history. If all the gold ever mined were melted down, it would form a cube with sides of approximately 21.7 meters (71 feet). Despite its abundance, the demand for gold continues to grow, driven by its unique properties and enduring appeal.

Conclusion: Gold’s Endless Fascination

Gold’s enduring allure lies in its rarity, beauty, and versatility. Whether you’re interested in gold for its investment potential, its historical significance, or its role in modern technology, there’s no denying that gold remains one of the most fascinating and valuable materials on Earth.

If you’re looking to learn more about gold, its market trends, or how to invest in gold, explore more articles and resources on GoldBuyingFacts.com. Whether you’re a seasoned investor or just starting, understanding these intriguing aspects of gold can enhance your appreciation of this precious metal.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

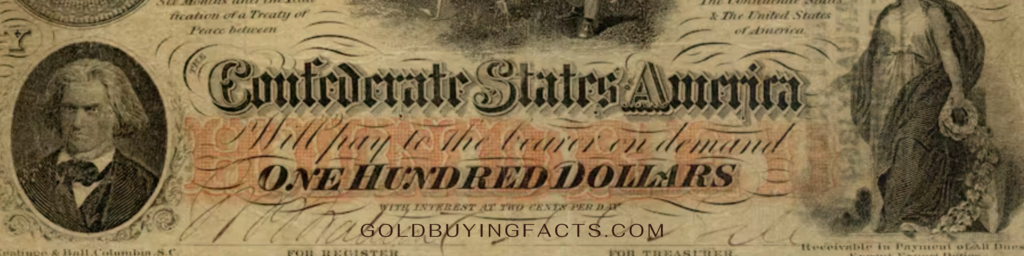

Confederate Money

Understanding Confederate Money: History, Value, and Its Connection to Gold

Confederate money, also known as Confederate currency, is a fascinating yet often misunderstood part of American history. Issued during the Civil War by the Confederate States of America (CSA), these notes have become collectibles due to their historical significance and the intriguing story they tell. But what exactly is Confederate money, and how does it relate to gold buying and collecting?

The History of Confederate Money

When the Southern states seceded from the Union in 1861, they needed a way to finance their war efforts. The Confederate government, lacking gold reserves and other means to back their currency, began printing paper money. Over the course of the Civil War, the Confederacy issued over $1 billion in paper money, in denominations ranging from 50 cents to $1,000.

Unlike Union currency, which was backed by gold, Confederate money was largely unsecured. This meant that the value of these notes was based solely on the confidence in the Confederate government, which quickly deteriorated as the war progressed. The rampant inflation and eventual defeat of the Confederacy rendered the money worthless in its original context, but today, these notes are prized by collectors for their historical value.

The Design and Varieties of Confederate Currency

Confederate money was beautifully designed, featuring portraits of Southern leaders, allegorical figures, and scenes of Southern life. Each note was printed in a variety of designs, with different printers producing notes in different states, leading to a wide array of variations. Some of the most common figures featured include Jefferson Davis, the President of the Confederacy, and C.G. Memminger, the Confederate Secretary of the Treasury.

There were also “interest-bearing” notes issued, designed to pay interest over a specified period. However, due to the collapse of the Confederate government, these notes never fulfilled their intended financial purpose.

The Value of Confederate Money Today

Today, Confederate money holds significant value as a collectible. However, its worth is not measured in its original face value but rather in its historical importance, rarity, and condition. Some notes are relatively common, while others, particularly those in pristine condition or with unique serial numbers, can fetch thousands of dollars at auction.

Factors affecting the value of Confederate money include:

- Rarity: Some notes were printed in limited quantities or have become rare due to time.

- Condition: As with all collectibles, notes in better condition are more valuable.

- Errors and Variants: Notes with printing errors or unusual variants can be especially prized by collectors.

Confederate Money and Gold

Interestingly, during the Civil War, gold remained a stable form of currency and was often hoarded as Confederate money lost its value. Today, collectors of Confederate money may also be interested in gold coins and bullion from the same era, as these tangible assets offer a stark contrast to the fleeting value of paper money.

Gold has always been a reliable store of value, and during periods of economic instability, such as the Civil War, it served as a crucial financial safeguard. This connection between Confederate money and gold continues to intrigue collectors, making both types of assets important in understanding the broader economic history of the time.

Should You Invest in Confederate Money?

For those interested in collecting Confederate money, it’s important to approach it as a historical investment rather than a financial one. Unlike gold, which has intrinsic value and can be easily liquidated, Confederate money is valued primarily for its historical and collectible appeal. If you’re interested in diversifying your collection or investment portfolio, gold remains a more stable and reliable option.

However, for history enthusiasts, Confederate money offers a unique glimpse into a turbulent period in American history. Owning a piece of this history can be rewarding, both intellectually and potentially financially, depending on the rarity and condition of the notes.

Conclusion

Confederate money is a captivating artifact from a bygone era, offering insight into the economic struggles of the Confederacy during the Civil War. While it may not hold the same tangible value as gold, it represents a significant piece of American history that continues to draw interest from collectors and historians alike. Whether you’re a seasoned collector or just starting, understanding the value and history of Confederate money can enrich your appreciation of both the currency and the era it comes from.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Gold: How Our Investment Saved Us During Financial Hardship

A Lifeline in Gold: How Our Gold Investment Saved Us

Life has a way of throwing unexpected challenges our way. In our case, it was a series of heartbreaking events that tested our resilience and financial stability. During these tough times, our gold investment became a lifeline, providing much-needed financial support when we had nowhere else to turn.

The Unforeseen Crisis

It all started with our beloved pet. Figaro was more than a pet; he was a cherished family member who brought us endless joy and companionship. One day, Figaro fell seriously ill. We rushed him to the veterinarian, only to be told that he needed an urgent and expensive surgery. The vet bills quickly mounted, and we found ourselves facing a daunting financial burden.

Just as we were grappling with Figaro’s medical expenses, we received a notice from the local government. Our property taxes had increased significantly, and we were required to pay the outstanding amount within a short period. The timing couldn’t have been worse. We were already stretched thin from Figaro’s vet bills, and now we were at risk of losing our home.

The Decision to Sell Gold

In the midst of this turmoil, we remembered our gold investment. Years ago, we purchased gold as a way to diversify our savings and protect against economic uncertainties. We never imagined that this investment would one day become our financial savior.

With heavy hearts, we decided to sell a portion of our gold. The decision was not easy; the gold represented years of careful planning and saving. But we knew it was the right choice. We needed the funds immediately, and our gold investment was the only asset that could provide us with the liquidity we required.

The Process of Selling Gold

Selling our gold was surprisingly straightforward. We contacted a reputable gold dealer who offered us a fair price based on the current market value. The process was transparent, and we received the funds within a few days. The relief we felt was immense. We were able to pay Figaro’s vet bills and ensure he received the treatment he needed to recover. Additionally, we settled our property taxes, securing our home from any legal complications.

The Emotional Journey

This experience was an emotional rollercoaster. Seeing Figaro suffer was heart-wrenching, and the stress of looming financial obligations took a toll on our family. However, our gold investment provided us with the financial cushion we desperately needed. It allowed us to focus on caring for Figaro and addressing our immediate needs without the constant worry of financial ruin.

A Golden Lining

Figaro’s recovery was slow but steady. The surgery was successful, and with proper care, he began to regain his strength. The joy of seeing him happy and healthy again was indescribable. Our home remained ours, and we were able to continue building our lives without the shadow of financial distress hanging over us.

This experience taught us the true value of our gold investment. It wasn’t just about the financial returns; it was about the security and peace of mind it provided during one of the most challenging periods of our lives. Gold became more than just an asset; it became a symbol of hope and resilience.

Why Invest in Gold?

Investing in gold offers several benefits, especially during times of financial hardship:

- Liquidity: Gold can be easily sold for cash, providing immediate funds when you need them most.

- Stability: Gold tends to maintain its value during economic downturns, offering a reliable store of value.

- Diversification: Including gold in your investment portfolio helps diversify risk and protect against market volatility.

- Security: Gold provides a financial safety net, giving you peace of mind knowing you have a valuable asset to fall back on.

Our story is a testament to the power of gold as a financial lifeline. If you’re considering ways to safeguard your future, investing in gold could be a wise choice. It offers stability, security, and the potential to be a lifesaver when unexpected challenges arise.

For more insights on gold investment and how it can benefit you, visit goldbuyingfacts.com, your trusted source for expert advice and up-to-date information.

Historical Performance of Gold During Economic Crises

10 Common Misconceptions About Investing in Gold

Top 10 Tips for Investing in Gold for Beginners

2024 Gold Market Trends and Predictions

2024 Gold Market Trends and Predictions

As we progress through 2024, the gold market continues to be a focal point for investors seeking stability amidst economic uncertainty. This article delves into current market trends, historical performance, and future predictions, providing a comprehensive analysis to help you navigate the gold investment landscape.

Current Market Trends

1. Economic Uncertainty and Inflation

Economic uncertainty and inflation concerns are key drivers of gold prices in 2024. With ongoing geopolitical tensions and fluctuating interest rates, investors are turning to gold as a safe-haven asset. The precious metal is traditionally viewed as a hedge against inflation, maintaining its value when the purchasing power of fiat currencies declines.

2. Central Bank Policies

Central banks worldwide continue to play a significant role in the gold market. Recent data indicates that several central banks, including those in China, India, and Russia, are increasing their gold reserves. This trend reflects a desire to diversify away from the US dollar and mitigate risks associated with currency devaluation.

3. Technological Advancements

Advancements in technology are also impacting gold demand. The growing use of gold in electronics, renewable energy technologies, and medical devices is creating new avenues for investment. As these technologies evolve, the industrial demand for gold is expected to rise.

4. Investment Demand

Investment demand for gold remains robust. Exchange-traded funds (ETFs) and physical gold purchases are popular among both institutional and retail investors. Gold-backed ETFs, in particular, provide a convenient way for investors to gain exposure to gold without the need to store physical bullion.

Historical Performance

1. Gold’s Long-Term Value

Historically, gold has proven to be a reliable store of value. Over the past decade, gold prices have experienced fluctuations, but the overall trend has been upward. During economic crises, such as the 2008 financial crisis and the COVID-19 pandemic, gold prices surged as investors sought refuge from volatile stock markets.

2. Price Movements

- 2008 Financial Crisis: Gold prices rose from around $800 per ounce in late 2008 to over $1,900 per ounce by mid-2011.

- COVID-19 Pandemic: In 2020, gold prices reached an all-time high of approximately $2,070 per ounce as the pandemic triggered widespread economic disruption.

3. Inflation Hedge

Gold’s performance as an inflation hedge is well-documented. During periods of high inflation, gold tends to outperform other asset classes. For instance, in the 1970s, when inflation rates were in double digits, gold prices increased dramatically.

Future Predictions

1. Continued Economic Uncertainty

Economic uncertainty is likely to persist throughout 2024, supporting gold prices. Factors such as geopolitical tensions, supply chain disruptions, and fluctuating interest rates will continue to drive investor interest in gold.

2. Rising Demand from Emerging Markets

Emerging markets, particularly in Asia, are expected to contribute to increased gold demand. As middle-class populations grow in countries like China and India, so does the appetite for gold jewelry and investment.

3. Sustainable Gold Mining Practices